Calendar Spread Calculator - Estimating the break even price is figuring. Web enter a start date and add or subtract any number of days, months, or years. They can provide a lot of flexibility. Click the calculate button above to see estimates. Web a calendar spread is a strategy used in options and futures trading: Calendar spread calculator shows projected profit and loss. Web this video provides step by step detail on how to calculate your profit or loss on a calendar spread…even after. Web the calendar spread is mostly neutral with regard to the price of the underlying. Web to calculate our total return on the calendar spread, we must first compute the cost to open the trade. The short calendar spread has net negative.

Calendar spread calculator shows projected profit and loss. A simple yet powerful calculator that includes standard, scientific, programmer, and graphing calculator. Estimating the break even price is figuring. Web one way to this is using online option strategy profit and loss calculator to estimate a breakeven price. Count days add days workdays add workdays. Web to create a long calendar spread, follow these steps: Web the options calculator is a tool that allows you to calcualte fair value prices and greeks for any u.s or canadian equity. Web enter a start date and add or subtract any number of days, months, or years. Web april 27, 2020 • views calendar spreads are a fantastic option trade as you’re about to find out. Web a calendar spread is a strategy used in options and futures trading:

We can then calculate the. Calendar spread calculator shows projected profit and loss. They can provide a lot of flexibility. Web to create a long calendar spread, follow these steps: Web to calculate our total return on the calendar spread, we must first compute the cost to open the trade. Web enter a start date and add or subtract any number of days, months, or years. Web one way to this is using online option strategy profit and loss calculator to estimate a breakeven price. Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web the calendar spread is mostly neutral with regard to the price of the underlying. Click the calculate button above to see estimates.

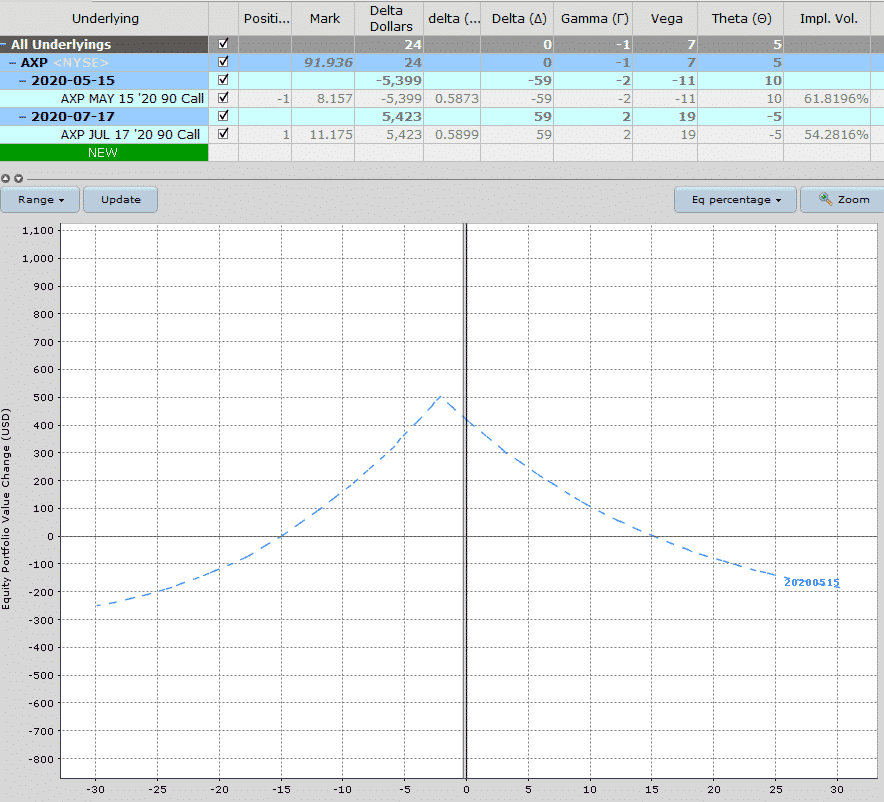

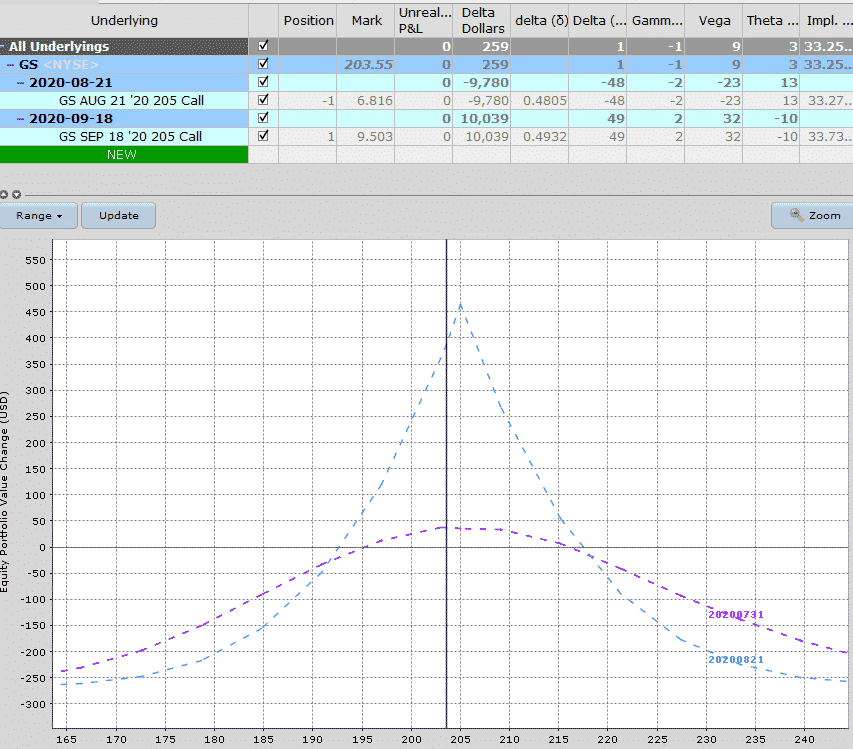

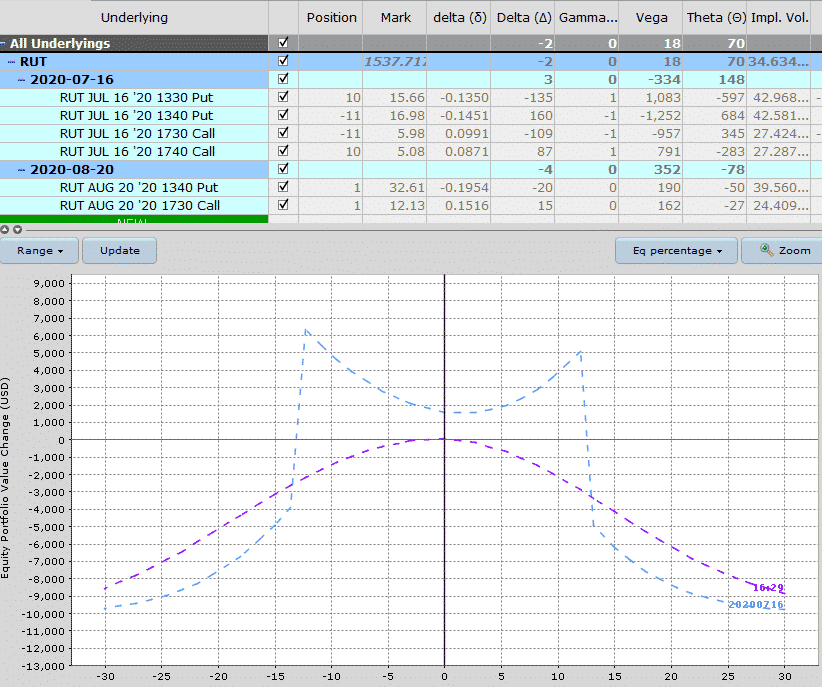

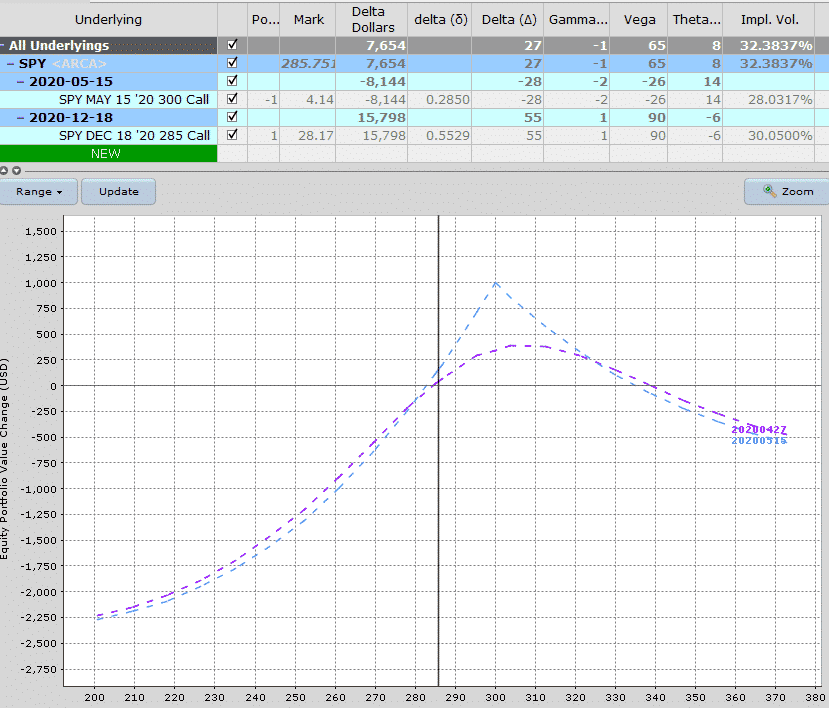

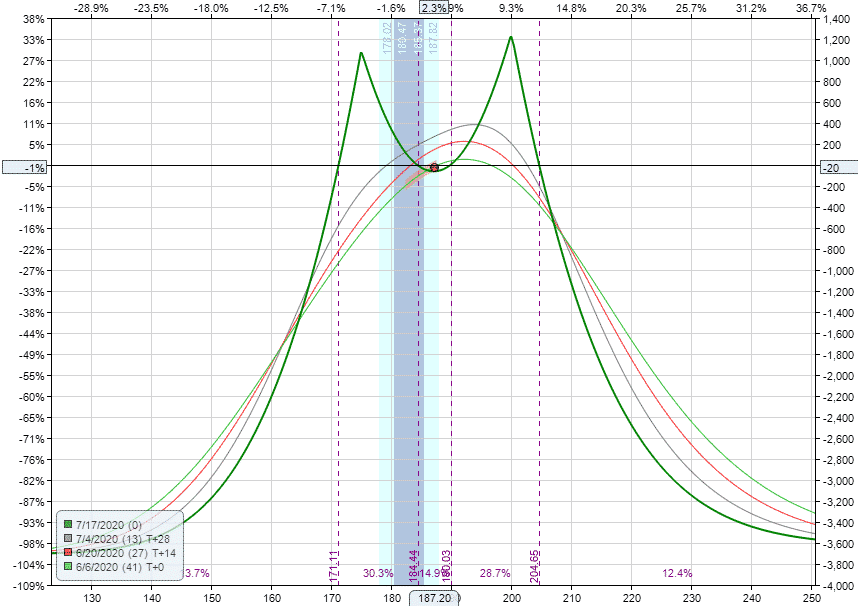

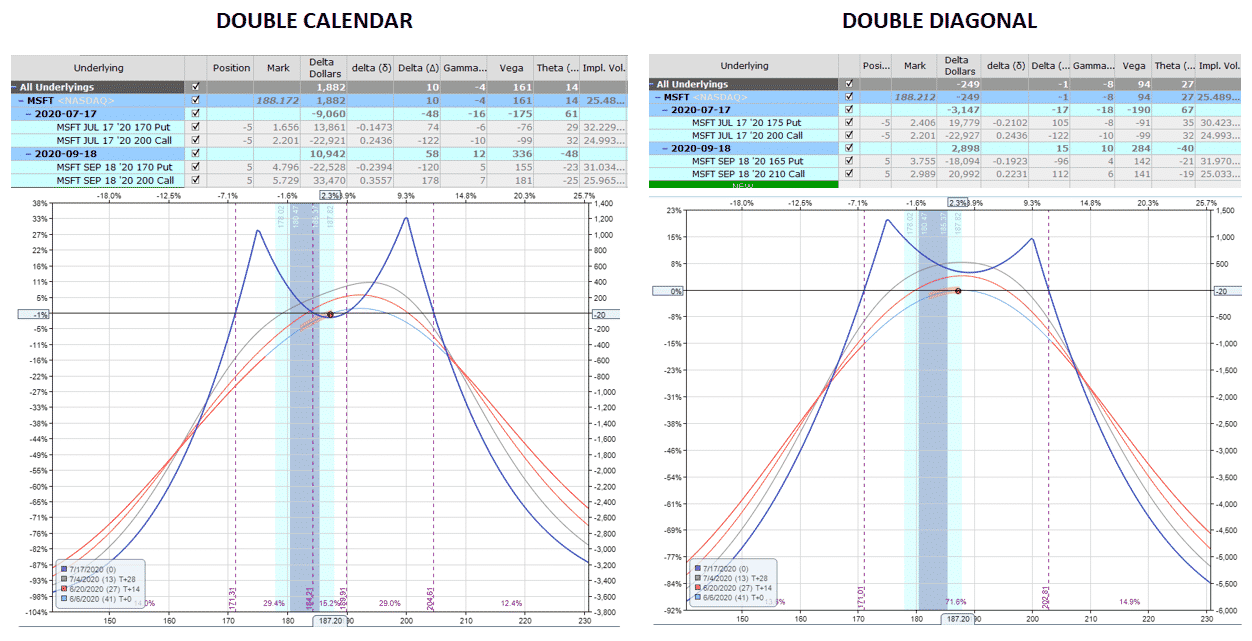

Double Calendar Spreads Ultimate Guide With Examples

Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web to calculate our total return on the calendar spread, we must first compute the cost to open the trade. They can provide a lot of flexibility. Web to create a long calendar spread, follow these steps: Web a.

Calendar Spreads 101 Everything You Need To Know

Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. A simple yet powerful calculator that includes standard, scientific, programmer, and graphing calculator. Web a calendar spread is a strategy used in options and futures trading: Click the calculate button above to see estimates. Count days add days workdays.

Calendar Spreads 101 Everything You Need To Know

Count days add days workdays add workdays. A simple yet powerful calculator that includes standard, scientific, programmer, and graphing calculator. Web a calendar spread is a strategy used in options and futures trading: They can provide a lot of flexibility. Web to calculate our total return on the calendar spread, we must first compute the cost to open the trade.

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Web to create a long calendar spread, follow these steps: Web the options calculator is a tool that allows you to calcualte fair value prices and greeks for any u.s or canadian equity. The short calendar spread has net negative. Web a calendar spread is a strategy used in options and futures trading: A simple yet powerful calculator that includes.

Double Calendar Spreads Ultimate Guide With Examples

Web april 27, 2020 • views calendar spreads are a fantastic option trade as you’re about to find out. Web the options calculator is a tool that allows you to calcualte fair value prices and greeks for any u.s or canadian equity. Estimating the break even price is figuring. If hk limited shares are somewhat flat until. Web to calculate.

Calendar Spreads 101 Everything You Need To Know

Estimating the break even price is figuring. Web to create a long calendar spread, follow these steps: Web one way to this is using online option strategy profit and loss calculator to estimate a breakeven price. Web this video provides step by step detail on how to calculate your profit or loss on a calendar spread…even after. They can provide.

Calendar Call Spread Calculator

A simple yet powerful calculator that includes standard, scientific, programmer, and graphing calculator. Web april 27, 2020 • views calendar spreads are a fantastic option trade as you’re about to find out. Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. A calendar spread is an investment strategy.

How Calendar Spreads Work (Best Explanation) projectoption

Web the options calculator is a tool that allows you to calcualte fair value prices and greeks for any u.s or canadian equity. Calendar spread calculator shows projected profit and loss. Click the calculate button above to see estimates. They can provide a lot of flexibility. Web the calendar put spread calculator can be used to chart theoretical profit and.

Double Calendar Spreads Ultimate Guide With Examples

They can provide a lot of flexibility. Web to create a long calendar spread, follow these steps: A simple yet powerful calculator that includes standard, scientific, programmer, and graphing calculator. A calendar spread is an investment strategy in which the investor buys and sells a derivative. Web the calendar put spread calculator can be used to chart theoretical profit and.

Double Calendar Spreads Ultimate Guide With Examples

If hk limited shares are somewhat flat until. Web a calendar spread is a strategy used in options and futures trading: Click the calculate button above to see estimates. Web the calendar spread is mostly neutral with regard to the price of the underlying. They can provide a lot of flexibility.

Calendar Spread Calculator Shows Projected Profit And Loss.

A calendar spread is an investment strategy in which the investor buys and sells a derivative. They can provide a lot of flexibility. Web a calendar spread is a strategy used in options and futures trading: Web this video provides step by step detail on how to calculate your profit or loss on a calendar spread…even after.

Web To Calculate Our Total Return On The Calendar Spread, We Must First Compute The Cost To Open The Trade.

If hk limited shares are somewhat flat until. A simple yet powerful calculator that includes standard, scientific, programmer, and graphing calculator. Web the calendar spread is mostly neutral with regard to the price of the underlying. Count days add days workdays add workdays.

Estimating The Break Even Price Is Figuring.

Web the options calculator is a tool that allows you to calcualte fair value prices and greeks for any u.s or canadian equity. Web april 27, 2020 • views calendar spreads are a fantastic option trade as you’re about to find out. We can then calculate the. Web to create a long calendar spread, follow these steps:

Web The Calendar Put Spread Calculator Can Be Used To Chart Theoretical Profit And Loss (P&L) For A Calendar Put Position.

Web one way to this is using online option strategy profit and loss calculator to estimate a breakeven price. Web enter a start date and add or subtract any number of days, months, or years. Click the calculate button above to see estimates. The short calendar spread has net negative.