Calendar Spread Put - This kre calendar put spread could turn. Web kre bearish calendar put spread appears to be a bargain at 21 cents. First you use the sell to open order to write puts based on the particular. Web when running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a. Today, we are going to look at a bearish put. Web put calendar spread. Web conclusion in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Calls for calendar spreads it is important to understand that the risk profile of a calendar spread is identical. Web what’s a put calendar spread?

Calls for calendar spreads it is important to understand that the risk profile of a calendar spread is identical. Web conclusion in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade. First you use the sell to open order to write puts based on the particular. Web a put calendar spread — sometimes called a horizontal spread — is a trading strategy that looks to take. Web when running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a. This kre calendar put spread could turn. Web put calendar spread. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Web what’s a put calendar spread? Web kre bearish calendar put spread appears to be a bargain at 21 cents.

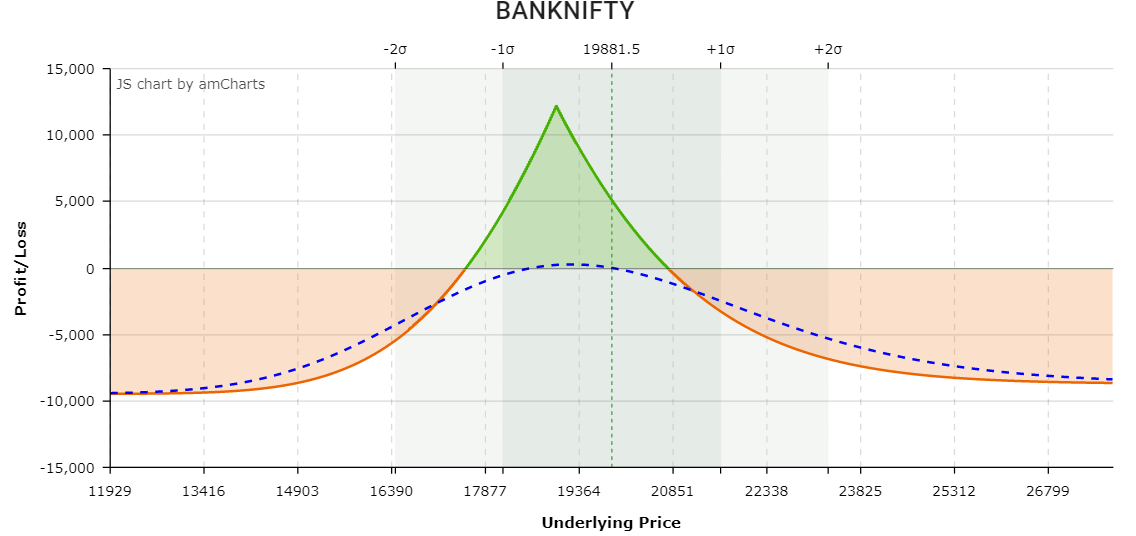

Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Web when running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a. Web a put calendar spread — sometimes called a horizontal spread — is a trading strategy that looks to take. First you use the sell to open order to write puts based on the particular. Web what’s a put calendar spread? This kre calendar put spread could turn. Calls for calendar spreads it is important to understand that the risk profile of a calendar spread is identical. Web kre bearish calendar put spread appears to be a bargain at 21 cents. Web put calendar spread. Today, we are going to look at a bearish put.

Calendar Spread and Long Calendar Option Strategies Market Taker

Web a put calendar spread — sometimes called a horizontal spread — is a trading strategy that looks to take. Web kre bearish calendar put spread appears to be a bargain at 21 cents. Calls for calendar spreads it is important to understand that the risk profile of a calendar spread is identical. First you use the sell to open.

Glossary Archive Tackle Trading

Web put calendar spread. Web what’s a put calendar spread? Web conclusion in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade. Calls for calendar spreads it is important to understand that the risk profile of a calendar spread is identical. This kre calendar put spread could turn.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web put calendar spread. This kre calendar put spread could turn. Web a put calendar spread — sometimes called a horizontal spread — is a trading strategy that looks to take. Today, we are going to look at a bearish put. First you use the sell to open order to write puts based on the particular.

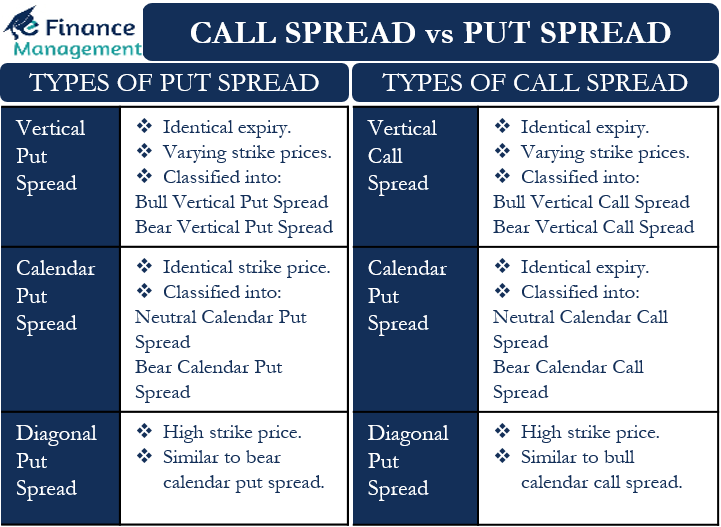

Call Spread vs Put Spread

Web what’s a put calendar spread? Web a put calendar spread — sometimes called a horizontal spread — is a trading strategy that looks to take. Web when running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a. This kre calendar put spread could turn..

Calendar Put Spread Options Edge

This kre calendar put spread could turn. Web put calendar spread. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Web kre bearish calendar put spread appears to be a bargain at 21 cents. Web a put calendar spread — sometimes called.

Long Calendar Spreads Unofficed

First you use the sell to open order to write puts based on the particular. Web a put calendar spread — sometimes called a horizontal spread — is a trading strategy that looks to take. Web put calendar spread. Web what’s a put calendar spread? Calls for calendar spreads it is important to understand that the risk profile of a.

Long Calendar Spreads Unofficed

First you use the sell to open order to write puts based on the particular. Calls for calendar spreads it is important to understand that the risk profile of a calendar spread is identical. Web put calendar spread. Web a put calendar spread — sometimes called a horizontal spread — is a trading strategy that looks to take. Web kre.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Today, we are going to look at a bearish put. Web a put calendar spread — sometimes called a horizontal spread — is a trading strategy that looks to take. First you use the sell to open order to write puts based on the particular. Web a short calendar spread with puts realizes its maximum profit if the stock price.

How Calendar Spreads Work (Best Explanation) projectoption

Web when running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a. Calls for calendar spreads it is important to understand that the risk profile of a calendar spread is identical. Web a put calendar spread — sometimes called a horizontal spread — is a.

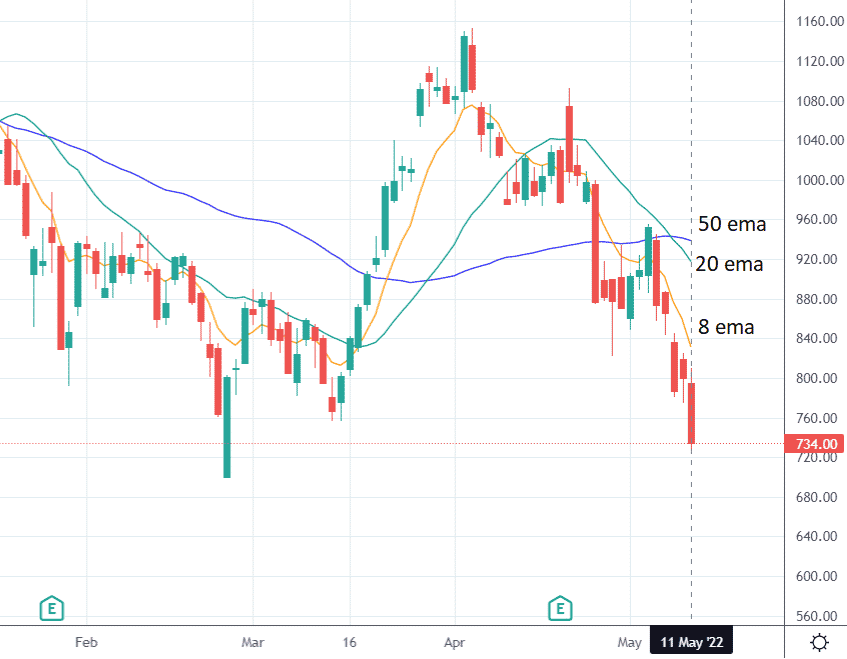

Bearish Put Calendar Spread Option Strategy Guide

Today, we are going to look at a bearish put. Web what’s a put calendar spread? First you use the sell to open order to write puts based on the particular. Web conclusion in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade. Web kre bearish calendar put spread.

Calls For Calendar Spreads It Is Important To Understand That The Risk Profile Of A Calendar Spread Is Identical.

This kre calendar put spread could turn. First you use the sell to open order to write puts based on the particular. Web conclusion in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade. Web put calendar spread.

Web Kre Bearish Calendar Put Spread Appears To Be A Bargain At 21 Cents.

Web what’s a put calendar spread? Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Web a put calendar spread — sometimes called a horizontal spread — is a trading strategy that looks to take. Web when running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)