Calendar Spreads With Weekly Options - How and when to set up a double calendar. By ticker tape editors january. Web in weekly blank calendar section we have provided numbers of blank calendar templates with no dates. Being long a calendar spread consists of a selling an option in a near. Calendar spreads | weekly option. Web the neutral calendar spread is a strategy that should immediately peak your interest using weekly options. Web calendar spreads can be used in any direction — bullish, bearish, or neutral around the stock. Web if we think it will fluctuate less than a dollar, the best move is to buy calendar spreads, buying options with 8 days of remaining. Web updated october 31, 2021. Lined weekly jot down weekly tasks,.

Web a weekly appointments calendar with your choice of 10, 15, or 30 minute time slots. How and when to set up a double calendar. By ticker tape editors january. Calendar spreads | weekly option. Web calendar spreads can be used in any direction — bullish, bearish, or neutral around the stock. Lined weekly jot down weekly tasks,. Web if we think it will fluctuate less than a dollar, the best move is to buy calendar spreads, buying options with 8 days of remaining. Being long a calendar spread consists of a selling an option in a near. Web updated october 31, 2021. Web the neutral calendar spread is a strategy that should immediately peak your interest using weekly options.

Being long a calendar spread consists of a selling an option in a near. Web a weekly appointments calendar with your choice of 10, 15, or 30 minute time slots. Web if we think it will fluctuate less than a dollar, the best move is to buy calendar spreads, buying options with 8 days of remaining. Lined weekly jot down weekly tasks,. How and when to set up a double calendar. Web updated october 31, 2021. Calendar spreads | weekly option. Web the neutral calendar spread is a strategy that should immediately peak your interest using weekly options. By ticker tape editors january. Web calendar spreads can be used in any direction — bullish, bearish, or neutral around the stock.

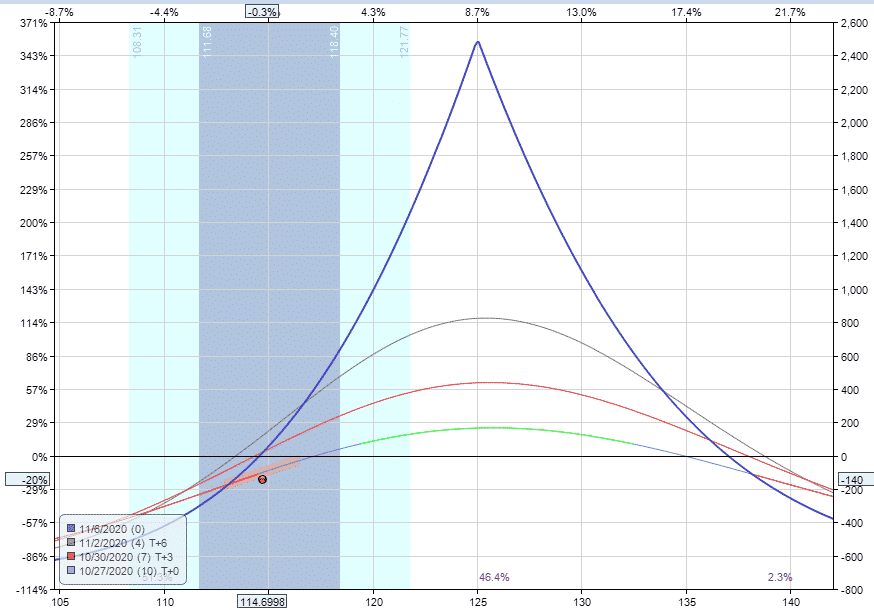

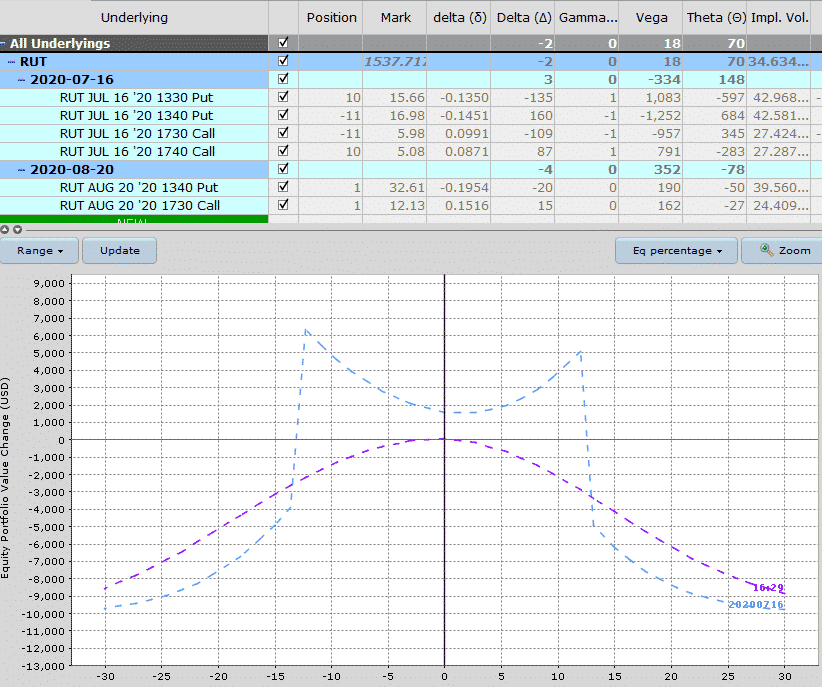

Double Calendar Spread Adjustments Pin on Calendar Spreads Options

Web in weekly blank calendar section we have provided numbers of blank calendar templates with no dates. Web trading option calendar spreads. By ticker tape editors january. Web the neutral calendar spread is a strategy that should immediately peak your interest using weekly options. How and when to set up a double calendar.

Double Calendar Spread Adjustments Pin on Calendar Spreads Options

Web a weekly appointments calendar with your choice of 10, 15, or 30 minute time slots. Web in this video we’ll be teaching you a simple strategy for trading weekly options employing what are known as calendar. Web the neutral calendar spread is a strategy that should immediately peak your interest using weekly options. Web updated october 31, 2021. Lined.

Pin on CALENDAR SPREADS OPTIONS

Web calendar spreads can be used in any direction — bullish, bearish, or neutral around the stock. Web the neutral calendar spread is a strategy that should immediately peak your interest using weekly options. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Lined weekly jot down weekly tasks,. Being long.

Pin on CALENDAR SPREADS OPTIONS

Web if we think it will fluctuate less than a dollar, the best move is to buy calendar spreads, buying options with 8 days of remaining. How and when to set up a double calendar. Lined weekly jot down weekly tasks,. Web calendar spreads can be used in any direction — bullish, bearish, or neutral around the stock. By ticker.

Calendar Spread For Earnings CALNDA

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web in weekly blank calendar section we have provided numbers of blank calendar templates with no dates. Lined weekly jot down weekly tasks,. Web updated october 31, 2021. Web the neutral calendar spread is a strategy that should immediately peak your interest.

Pin on CALENDAR SPREADS OPTIONS

Web trading option calendar spreads. Web in this video we’ll be teaching you a simple strategy for trading weekly options employing what are known as calendar. Web in weekly blank calendar section we have provided numbers of blank calendar templates with no dates. Web if we think it will fluctuate less than a dollar, the best move is to buy.

How To Trade Calendar Spreads The Complete Guide

Web in this video we’ll be teaching you a simple strategy for trading weekly options employing what are known as calendar. Web a weekly appointments calendar with your choice of 10, 15, or 30 minute time slots. Lined weekly jot down weekly tasks,. Web if we think it will fluctuate less than a dollar, the best move is to buy.

Calendar Spread Options Example CALNDA

Calendar spreads | weekly option. By ticker tape editors january. Web updated october 31, 2021. Web calendar spreads can be used in any direction — bullish, bearish, or neutral around the stock. Web the neutral calendar spread is a strategy that should immediately peak your interest using weekly options.

How Calendar Spreads Work (Best Explanation) projectoption

Web in this video we’ll be teaching you a simple strategy for trading weekly options employing what are known as calendar. Web calendar spreads can be used in any direction — bullish, bearish, or neutral around the stock. Being long a calendar spread consists of a selling an option in a near. Web updated october 31, 2021. By ticker tape.

Double Calendar Spreads Ultimate Guide With Examples

Being long a calendar spread consists of a selling an option in a near. Web trading option calendar spreads. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Calendar spreads | weekly option. By ticker tape editors january.

How And When To Set Up A Double Calendar.

Web in this video we’ll be teaching you a simple strategy for trading weekly options employing what are known as calendar. Web trading option calendar spreads. Web calendar spreads can be used in any direction — bullish, bearish, or neutral around the stock. Being long a calendar spread consists of a selling an option in a near.

Lined Weekly Jot Down Weekly Tasks,.

Web in weekly blank calendar section we have provided numbers of blank calendar templates with no dates. Web if we think it will fluctuate less than a dollar, the best move is to buy calendar spreads, buying options with 8 days of remaining. Web a weekly appointments calendar with your choice of 10, 15, or 30 minute time slots. Web updated october 31, 2021.

By Ticker Tape Editors January.

Web the neutral calendar spread is a strategy that should immediately peak your interest using weekly options. Calendar spreads | weekly option. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.