Calendar Year Proration Method - Web prorate a specified amount over a specified portion of the calendar year. 9728) on the allocation of partnership items when a. A property's daily tax rate is $1.23 and. This calculator is designed to estimate the real estate tax proration. The end date is december 22,. On july 31, 2015, the irs issued final regulations (t.d. Web calendar year of proration means the calendar year in which the closing occurs. Taxes and assessments, insurance, assumed interest, rents, and other expenses and revenue of the properties. The start date is august 12, 2019; Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for.

Web related to date of proration. A property's daily tax rate is $1.23 and. The start date is august 12, 2019; Web the partnership reports ordinary income of $100,000 for the current year without considering this transaction. On july 31, 2015, the irs issued final regulations (t.d. Web prorate a specified amount over a specified portion of the calendar year. The end date is december 22,. Web example 1 the annual amount of a billing schedule is 5000.00. “closing” shall mean the consummation of. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for.

Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for. The start date is august 12, 2019; Web example 1 the annual amount of a billing schedule is 5000.00. Web prorate a specified amount over a specified portion of the calendar year. Web step 2 final answer previous question next question transcribed image text: A property's daily tax rate is $1.23 and. Web the partnership reports ordinary income of $100,000 for the current year without considering this transaction. Proration for the month and year in which this agreement becomes effective or terminates, there. Web assuming the buyer owns the day of closing and assuming a calendar year proration, which of the following. Web how do you calculate the monthly rate for annual taxes using a statutory year?

Calendar Method How to Monitor Your Safe Days and Avoid Pregnancy

Web proration date shall have the meaning given to such term in section 11.2 (a) hereof. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at. Proration date means the closing date. Web property tax proration calculator. Taxes and assessments, insurance, assumed interest, rents, and other expenses.

Australia Calendar 2017 Free Printable PDF templates

Web assuming the buyer owns the day of closing and assuming a calendar year proration, which of the following. On july 31, 2015, the irs issued final regulations (t.d. “closing” shall mean the consummation of. Web proration date shall have the meaning given to such term in section 11.2 (a) hereof. Web sean is admitted to the calender year xyz.

Depreciation Calculation for Table and Calculated Methods (Oracle

9728) on the allocation of partnership items when a. Taxes and assessments, insurance, assumed interest, rents, and other expenses and revenue of the properties. This calculator is designed to estimate the real estate tax proration. Proration date means the closing date. The start date is august 12, 2019;

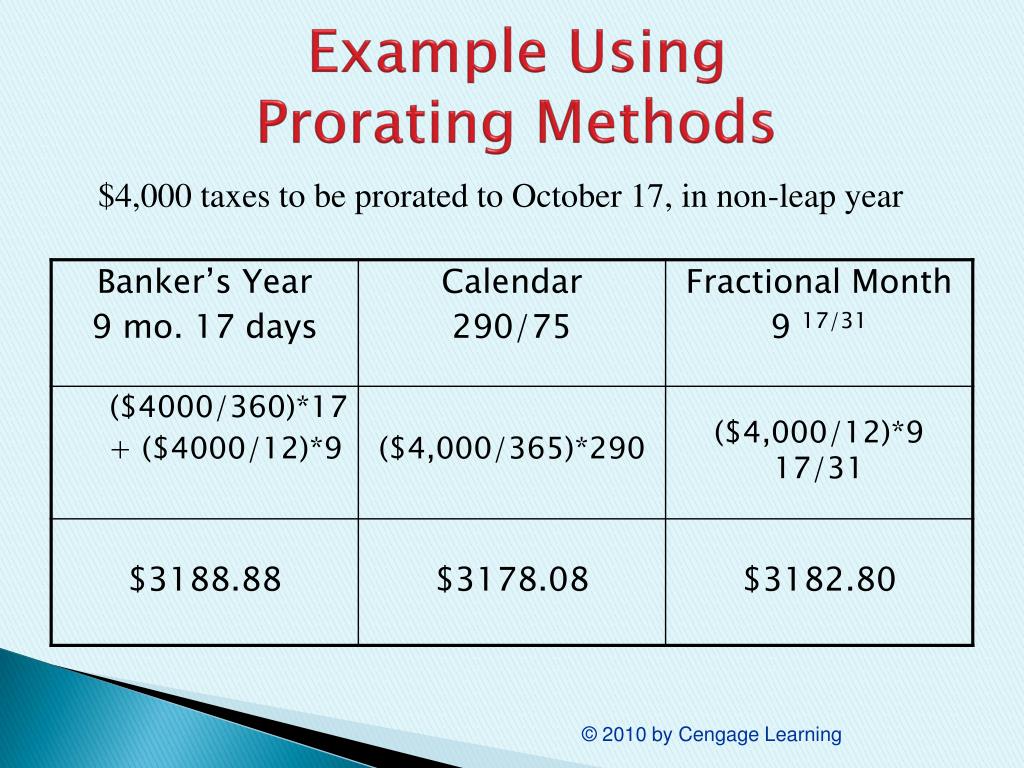

PPT Chapter 16 ________________ Title Closing and Escrow PowerPoint

Web property tax proration calculator. Web step 2 final answer previous question next question transcribed image text: Proration for the month and year in which this agreement becomes effective or terminates, there. Web the partnership reports ordinary income of $100,000 for the current year without considering this transaction. Web proration date shall have the meaning given to such term in.

SSA POMS DI 52170.055 Calendars for Proration (19642028) 09/25/2008

A property's daily tax rate is $1.23 and. Web calendar year of proration means the calendar year in which the closing occurs. Taxes and assessments, insurance, assumed interest, rents, and other expenses and revenue of the properties. Web property tax proration calculator. Web sean is admitted to the calender year xyz partnership on december 1 of the current year in.

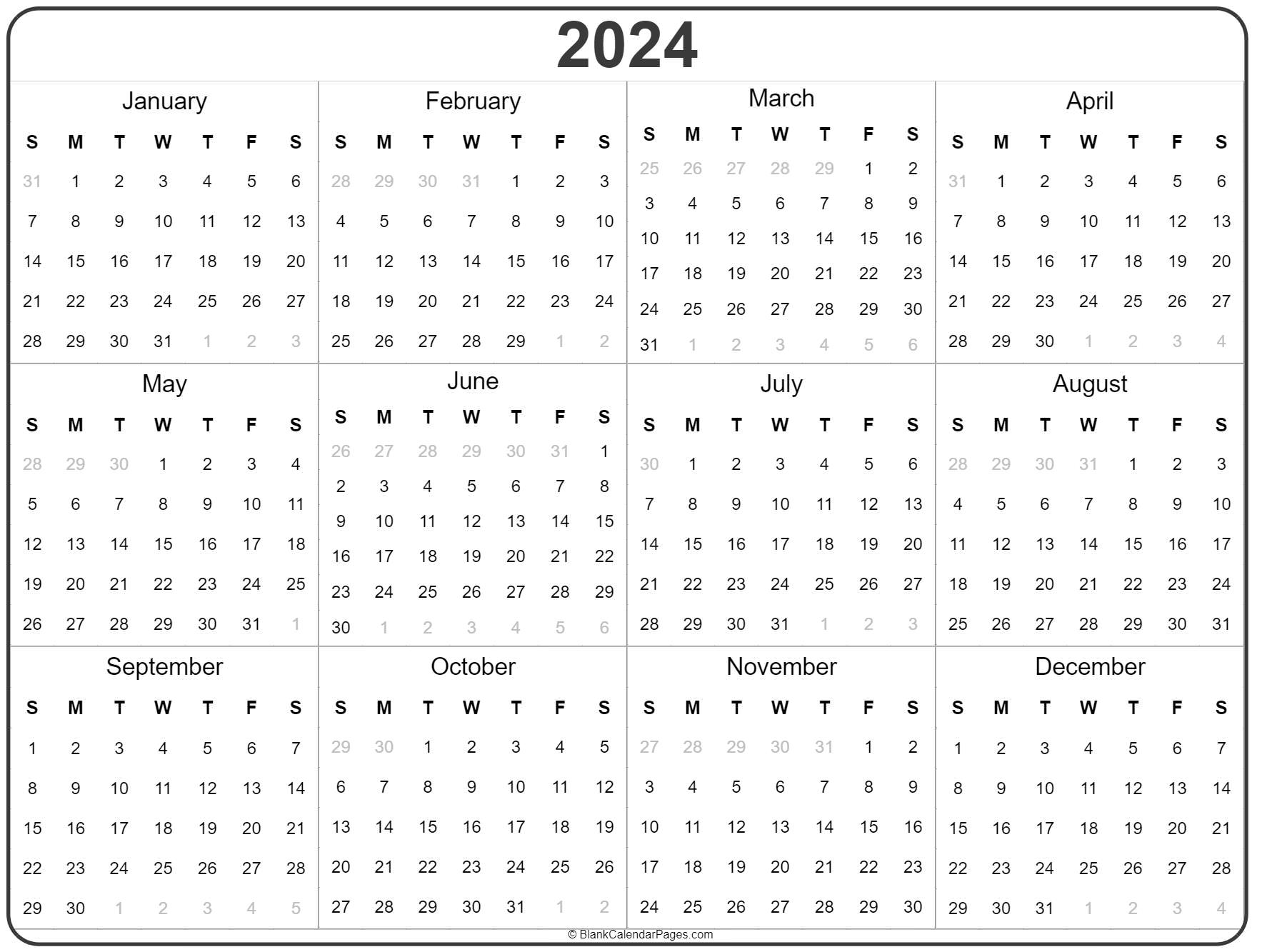

Calendar Year Proration Method 2024 New Ultimate The Best Review of

Web example 1 the annual amount of a billing schedule is 5000.00. Proration is inclusive of both specified dates. Web calendar year of proration means the calendar year in which the closing occurs. Web proration date shall have the meaning given to such term in section 11.2 (a) hereof. Web assuming the buyer owns the day of closing and assuming.

PRORFETY How Many Months Are Property Taxes Collected At Closing In Nc

Using a calendar year, what would the daily rate be. On july 31, 2015, the irs issued final regulations (t.d. Web sean is admitted to the calender year xyz partnership on december 1 of the current year in return for his services managing. Taxes and assessments, insurance, assumed interest, rents, and other expenses and revenue of the properties. Proration for.

Calendar Method How You Can Tell If You Are Ovulating

Web how do you calculate the monthly rate for annual taxes using a statutory year? Web property tax proration calculator. Web related to date of proration. On july 31, 2015, the irs issued final regulations (t.d. A proration is a form of monetary payment that buyers and sellers of real estate adjust for a specific time.

Keep running and Keep fighting Calendar and Workplan ( Design

Web proration date shall have the meaning given to such term in section 11.2 (a) hereof. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for. Web property tax proration calculator. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe.

The Complete Guide To The Calendar Method Birth Control

On july 31, 2015, the irs issued final regulations (t.d. The start date is august 12, 2019; Web example 1 the annual amount of a billing schedule is 5000.00. Web the partnership reports ordinary income of $100,000 for the current year without considering this transaction. Web prorate a specified amount over a specified portion of the calendar year.

Web Assuming The Buyer Owns The Property On Closing Day, And The Seller Hasn't Made Any Payments, What Will The Seller Owe At.

Web proration date shall have the meaning given to such term in section 11.2 (a) hereof. Web related to date of proration. Web the partnership reports ordinary income of $100,000 for the current year without considering this transaction. “closing” shall mean the consummation of.

On July 31, 2015, The Irs Issued Final Regulations (T.d.

9728) on the allocation of partnership items when a. A proration is a form of monetary payment that buyers and sellers of real estate adjust for a specific time. This calculator is designed to estimate the real estate tax proration. Web calendar year of proration means the calendar year in which the closing occurs.

Web Property Tax Proration Calculator.

The start date is august 12, 2019; Taxes and assessments, insurance, assumed interest, rents, and other expenses and revenue of the properties. Using a calendar year, what would the daily rate be. Web sean is admitted to the calender year xyz partnership on december 1 of the current year in return for his services managing.

Proration For The Month And Year In Which This Agreement Becomes Effective Or Terminates, There.

Proration is inclusive of both specified dates. A property's daily tax rate is $1.23 and. Web how do you calculate the monthly rate for annual taxes using a statutory year? Web example 1 the annual amount of a billing schedule is 5000.00.