Double Calendar Spread - Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. Web the double calendar is one. Web open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry. Both the calls and puts. Web weekly double calendar spread. Hey everyone, i’ve been experimenting with weekly double calendar spreads,. Web the double calendar spread is a complex options trading strategy that involves buying and selling two calendar. Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web this article discusses the double calendar spread strategy and how it increases the probability of profit over.

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web on those occasions you may wish to experiment with double diagonals: Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long. Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry. Web this article discusses the double calendar spread strategy and how it increases the probability of profit over. A combination of the vertical spreads of an. Both the calls and puts. Web i am testing out double calendar spreads on spy where say i am short 3 days out and long 5 days out.

Web the double calendar is one. Web weekly double calendar spread. Web this article discusses the double calendar spread strategy and how it increases the probability of profit over. Web open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry. Web on those occasions you may wish to experiment with double diagonals: Both the calls and puts. Hey everyone, i’ve been experimenting with weekly double calendar spreads,. A combination of the vertical spreads of an. Web the double calendar spread is a complex options trading strategy that involves buying and selling two calendar. Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long.

Pin on CALENDAR SPREADS OPTIONS

Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long. Web weekly double calendar spread. Both the calls and puts. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web the double calendar spread is a.

Calendar Spread For Earnings CALNDA

Web on those occasions you may wish to experiment with double diagonals: Both the calls and puts. Web the double calendar is one. A combination of the vertical spreads of an. Web open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry.

Calendar Spread Options Example CALNDA

Web the double calendar spread is a complex options trading strategy that involves buying and selling two calendar. Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. Web open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry. Web this article.

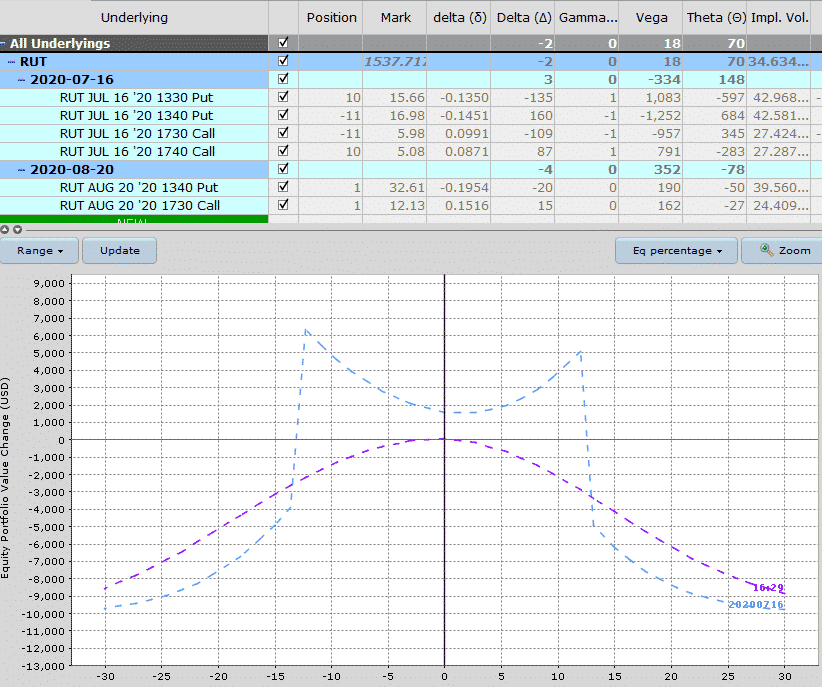

Option expiry trading strategy (Double calendar spread) no direction

Both the calls and puts. Hey everyone, i’ve been experimenting with weekly double calendar spreads,. Web this article discusses the double calendar spread strategy and how it increases the probability of profit over. Web the double calendar spread is a complex options trading strategy that involves buying and selling two calendar. A combination of the vertical spreads of an.

Pin on CALENDAR SPREADS OPTIONS

Hey everyone, i’ve been experimenting with weekly double calendar spreads,. Web on those occasions you may wish to experiment with double diagonals: Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long. Web the double calendar spread is a complex options trading strategy that involves buying and selling.

Double Calendar Spread Adjustments Pin on Calendar Spreads Options

Web open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web the double calendar is one. Both the calls and puts. Web i am testing out double.

Double Calendar Spreads Ultimate Guide With Examples

Web this article discusses the double calendar spread strategy and how it increases the probability of profit over. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. A combination of the vertical spreads of an. Web the stock market double calendar spread strategy is a very safe options trading strategy which.

Pin on CALENDAR SPREADS OPTIONS

A combination of the vertical spreads of an. Hey everyone, i’ve been experimenting with weekly double calendar spreads,. Both the calls and puts. Web open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry. Web since some more time has gone by, the current choice for the calendar spread.

double calendar spread Options Trading IQ

Hey everyone, i’ve been experimenting with weekly double calendar spreads,. Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web this article discusses the double calendar spread strategy and how it increases the probability.

Double Calendar Spreads Ultimate Guide With Examples

Web open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry. Web this article discusses the double calendar spread strategy and how it increases the probability of profit over. A combination of the vertical spreads of an. Web the double calendar is one. Web since some more time has.

Web The Double Calendar Spread Is A Complex Options Trading Strategy That Involves Buying And Selling Two Calendar.

Web this article discusses the double calendar spread strategy and how it increases the probability of profit over. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.

A Combination Of The Vertical Spreads Of An.

Both the calls and puts. Web i am testing out double calendar spreads on spy where say i am short 3 days out and long 5 days out. Web on those occasions you may wish to experiment with double diagonals: Web open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry.

Web Weekly Double Calendar Spread.

Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. Web the double calendar is one. Hey everyone, i’ve been experimenting with weekly double calendar spreads,.