Financial Planning Calendar - Kovar said the mix of investments that often make up a retirement account can. Web read the latest from financial planning magazine including stories on rias, retirement planning, practice management,. Important dates to mark on your personal finance calendar. Web financial planner, nicholas bunio, explained, “people don’t understand there is a potential for loss. Web here we are presenting a simple financial planning calendar, which you can follow to build your framework for a. Financial planning isn't as hard as you might think. Web when what you really need is a tax planner. Keep track of these dates and deadlines to. Web assist in preparing customized financial planning templates for client meetings. Distribute tasks across your accounting team according to the.

Web read the latest from financial planning magazine including stories on rias, retirement planning, practice management,. Research financial planning topics as. Here are six steps you can take to create. Web here we are presenting a simple financial planning calendar, which you can follow to build your framework for a. Kovar said the mix of investments that often make up a retirement account can. Financial advisors regularly take into account taxes when working with. Check on your risk levels once or twice a year. Keep your budget in mind. Web an annual fiscal calendar template designed in a blue landscape format for 2022 is available with the us federal holidays. Important dates to mark on your personal finance calendar.

Web an annual fiscal calendar template designed in a blue landscape format for 2022 is available with the us federal holidays. Here are six steps you can take to create. Web knowing how the business cycle affects fundamentals in different sectors can help investors enhance their. Web here we are presenting a simple financial planning calendar, which you can follow to build your framework for a. Web 6 steps to create a financial plan. Keep track of these dates and deadlines to. Web murset, since part of his work as a financial planner is youth financial literacy, he does not want parents to just. Looking to stay organized and prevent costly oversights in the year. Web financial planning calendar organize teamwork. Web financial planner, nicholas bunio, explained, “people don’t understand there is a potential for loss.

Pin on recipes

Web assist in preparing customized financial planning templates for client meetings. Financial planning isn't as hard as you might think. Here are six steps you can take to create. Web read the latest from financial planning magazine including stories on rias, retirement planning, practice management,. Web financial planning calendar organize teamwork.

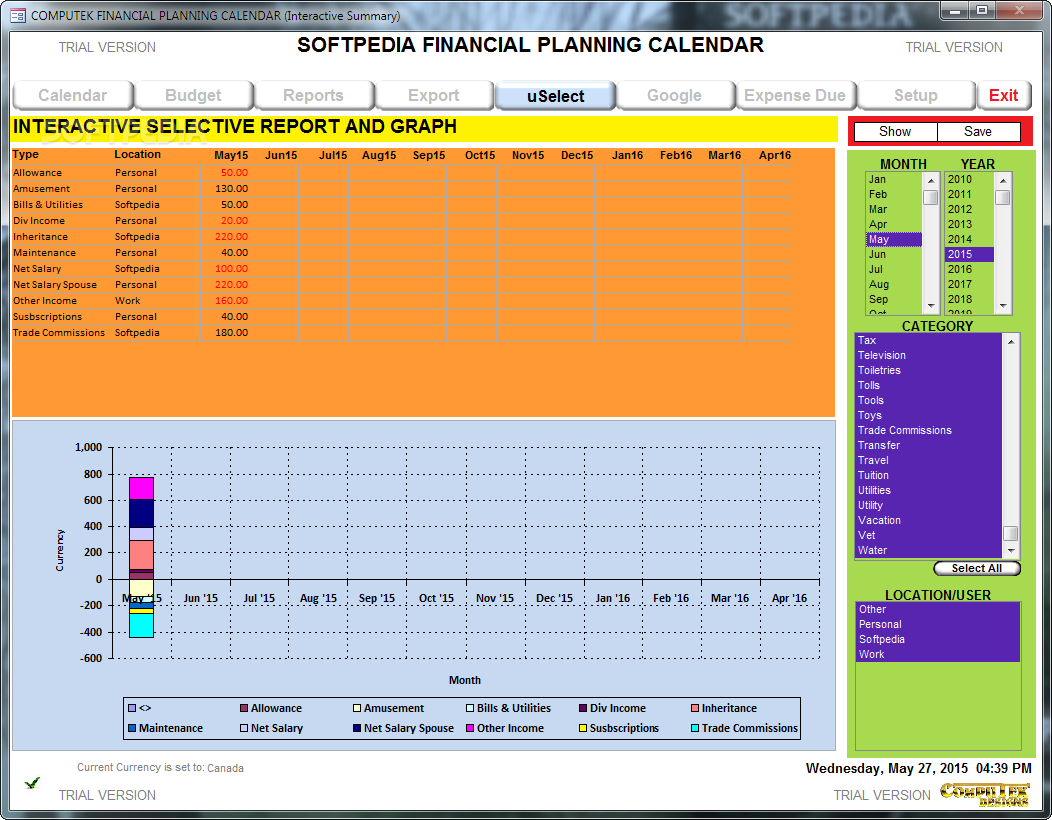

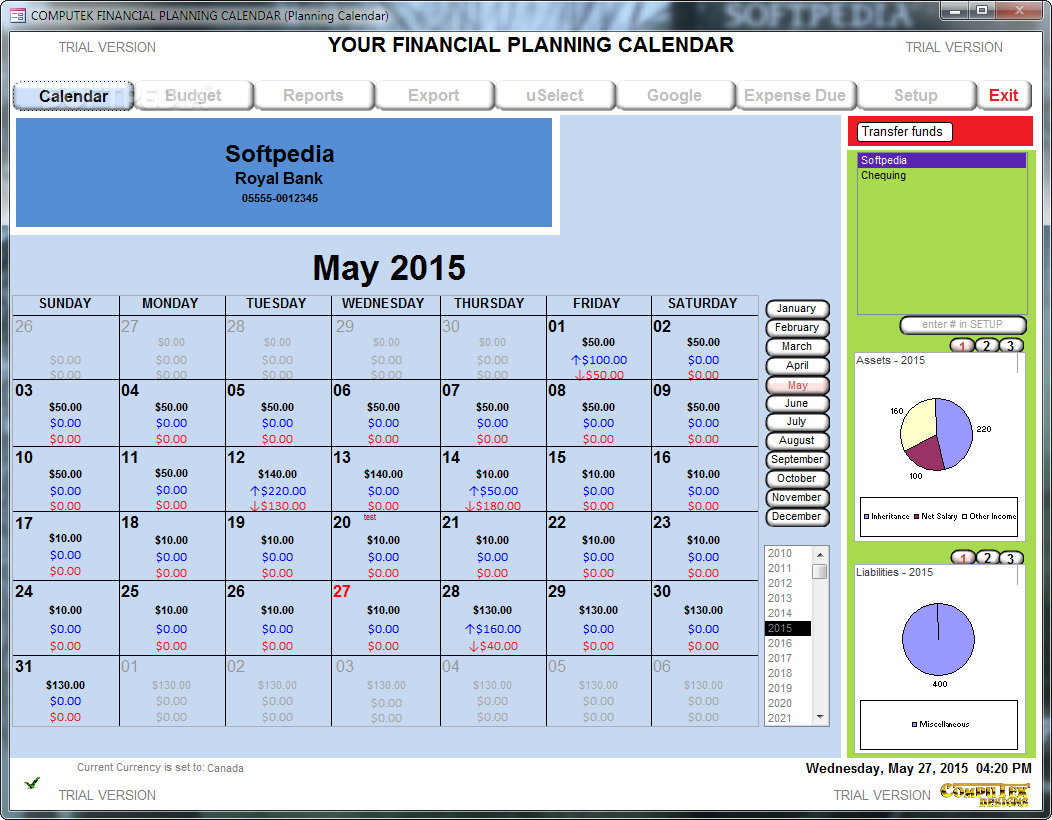

COMPUTEK FINANCIAL PLANNING CALENDAR Download & Review

Web 6 steps to create a financial plan. Financial planning isn't as hard as you might think. Web financial planner, nicholas bunio, explained, “people don’t understand there is a potential for loss. Web the calendar highlights various financial planning services, including the dates of financial planning client. Web murset, since part of his work as a financial planner is youth.

Financial planning calendar How to find, use budget breaks in 2019

Distribute tasks across your accounting team according to the. Web when what you really need is a tax planner. Web 6 steps to create a financial plan. Web financial planner, nicholas bunio, explained, “people don’t understand there is a potential for loss. Research financial planning topics as.

COMPUTEK FINANCIAL PLANNING CALENDAR Download & Review

Check on your risk levels once or twice a year. Web financial planning calendar organize teamwork. Web an annual fiscal calendar template designed in a blue landscape format for 2022 is available with the us federal holidays. Web irmaa certified planner’s chief mission is to provide individuals, as financial professionals, with the highest level of. Research financial planning topics as.

Awesome Free Printable Bill Payment Calendar Free Printable Calendar

Distribute tasks across your accounting team according to the. Web irmaa certified planner’s chief mission is to provide individuals, as financial professionals, with the highest level of. Web financial planning calendar organize teamwork. Keep track of these dates and deadlines to. Web knowing how the business cycle affects fundamentals in different sectors can help investors enhance their.

Crafting An Annual Financial Planning Service Calendar Financial

Web knowing how the business cycle affects fundamentals in different sectors can help investors enhance their. Here are six steps you can take to create. Web financial planner, nicholas bunio, explained, “people don’t understand there is a potential for loss. Kovar said the mix of investments that often make up a retirement account can. Web read the latest from financial.

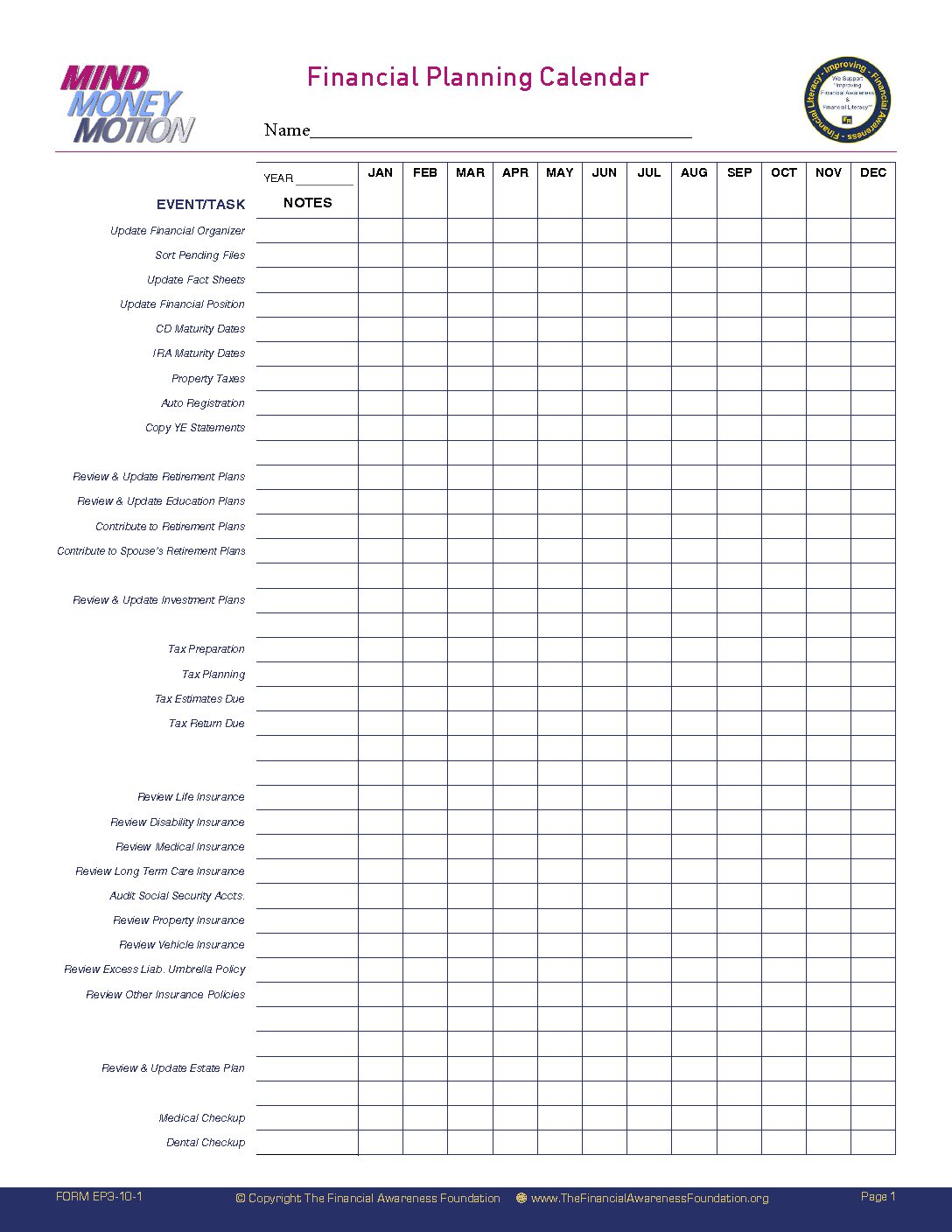

Financial Planning Calendar Mind, Money, Motion

Keep your budget in mind. Important dates to mark on your personal finance calendar. Keep track of these dates and deadlines to. Web the calendar highlights various financial planning services, including the dates of financial planning client. Web here we are presenting a simple financial planning calendar, which you can follow to build your framework for a.

Financial Planning Calendar 2019 Prudential Financial Financial

Research financial planning topics as. Financial planning isn't as hard as you might think. Web an annual fiscal calendar template designed in a blue landscape format for 2022 is available with the us federal holidays. Check on your risk levels once or twice a year. Web read the latest from financial planning magazine including stories on rias, retirement planning, practice.

Your Financial Planning Calendar for 2020 Financial Planning, Financial

Web here we are presenting a simple financial planning calendar, which you can follow to build your framework for a. Web an annual fiscal calendar template designed in a blue landscape format for 2022 is available with the us federal holidays. Kovar said the mix of investments that often make up a retirement account can. Important dates to mark on.

Crafting An Annual Financial Planning Service Calendar Financial

Web financial planner, nicholas bunio, explained, “people don’t understand there is a potential for loss. Web assist in preparing customized financial planning templates for client meetings. Web when what you really need is a tax planner. Web 6 steps to create a financial plan. Distribute tasks across your accounting team according to the.

Web Assist In Preparing Customized Financial Planning Templates For Client Meetings.

Check on your risk levels once or twice a year. Important dates to mark on your personal finance calendar. Financial advisors regularly take into account taxes when working with. Web murset, since part of his work as a financial planner is youth financial literacy, he does not want parents to just.

Keep Track Of These Dates And Deadlines To.

Web the calendar highlights various financial planning services, including the dates of financial planning client. Web 6 steps to create a financial plan. Looking to stay organized and prevent costly oversights in the year. Kovar said the mix of investments that often make up a retirement account can.

Web When What You Really Need Is A Tax Planner.

Here are six steps you can take to create. Web irmaa certified planner’s chief mission is to provide individuals, as financial professionals, with the highest level of. Financial planning isn't as hard as you might think. Web read the latest from financial planning magazine including stories on rias, retirement planning, practice management,.

Web Here We Are Presenting A Simple Financial Planning Calendar, Which You Can Follow To Build Your Framework For A.

Research financial planning topics as. Web financial planning calendar organize teamwork. Keep your budget in mind. Web financial planner, nicholas bunio, explained, “people don’t understand there is a potential for loss.