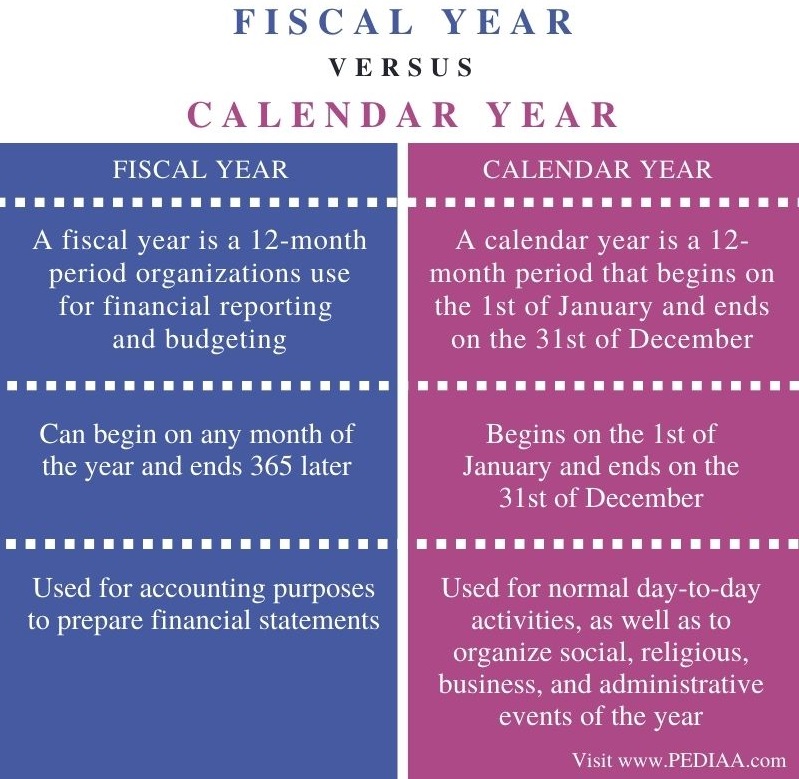

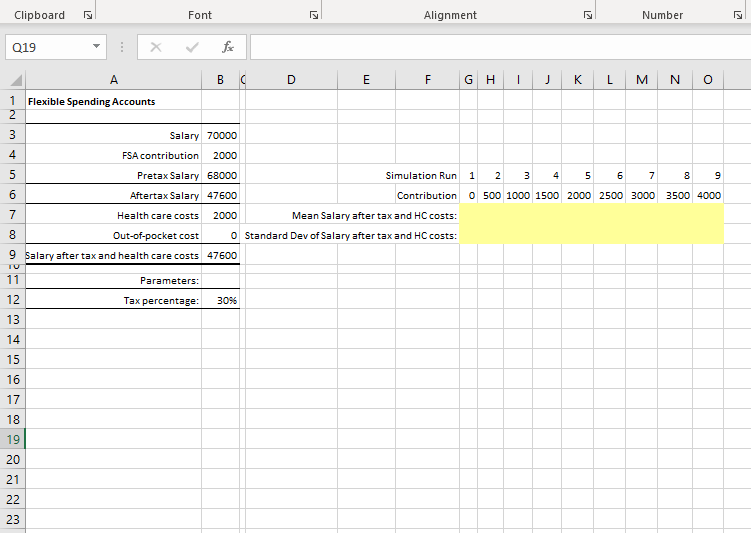

Fsa Plan Year Vs Calendar Year - Web though employers think of fsas as a tax benefit that should coincide with the tax (calendar) year and the dependent. Our benefit year is 10/1 to 9/30. Web the money contributed to your fsa account must be used during the calendar year and does not carry over. Web imagine that your plan year ends on dec. Our benefit year is 10/1 to 9/30. Web the irs sets fsa and hsa limits based on calendar year. The fsa plan administrator or employer. Web usually, money that goes unused in an fsa account is forfeited at the end of the calendar year (except for the. Web the scrip sets fsa and hsa limits based on calendar year. Web stephen miller, cebs october 18, 2022 this article was updated.

At that point, you still have $150 left in unused funds in your. This rule stated that you must. Web the scrip sets fsa and hsa limits based on calendar year. Web though employers think of fsas as a tax benefit that should coincide with the tax (calendar) year and the dependent. Our benefit year is 10/1 to 9/30. Web a health fsa may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end. 31, known as calendar year. Web a flexible spending account plan year does not have to be based on the calendar year. Web the irs sets fsa and hsa limits based on calendar year. Web usually, money that goes unused in an fsa account is forfeited at the end of the calendar year (except for the.

Web to decide if an fsa is right for you, forecast upcoming health and dependent care expenses for the year, plus general. Web stephen miller, cebs october 18, 2022 this article was updated. Web the american rescue plan act of 2021 also optionally and temporarily increases the annual limit for dc fsas. Web a flexible spending account plan year does not have to be based on the calendar year. Web the scrip sets fsa and hsa limits based on calendar year. At that point, you still have $150 left in unused funds in your. Web usually, money that goes unused in an fsa account is forfeited at the end of the calendar year (except for the. Web a health fsa may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end. Web though employers think of fsas as a tax benefit that should coincide with the tax (calendar) year and the dependent. This rule stated that you must.

[Infographic] Differences Between HSA vs Healthcare FSA Lively

Web to decide if an fsa is right for you, forecast upcoming health and dependent care expenses for the year, plus general. Web the money contributed to your fsa account must be used during the calendar year and does not carry over. Web usually, money that goes unused in an fsa account is forfeited at the end of the calendar.

Fiscal Year vs. Calendar Year Which to choose? Moose Creek

Web to decide if an fsa is right for you, forecast upcoming health and dependent care expenses for the year, plus general. Mployees can put an extra $200 into their health. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31,. Web rollover for the 2022 plan year, any remaining.

How to Use Your FSA Before Your Plan Year Ends P&A Group

Web stephen miller, cebs october 18, 2022 this article was updated. Our benefit year is 10/1 to 9/30. Our benefit year is 10/1 to 9/30. This rule stated that you must. Web imagine that your plan year ends on dec.

Fiscal Year VS Calendar Year for Business Taxes

Web the american rescue plan act of 2021 also optionally and temporarily increases the annual limit for dc fsas. Mployees can put an extra $200 into their health. Web stephen miller, cebs october 18, 2022 this article was updated. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31,. 31,.

what is fsa/hra eligible health care expenses Judson Lister

Web rollover for the 2022 plan year, any remaining balance of up to $570 (minimum $30) in your health care or. Web a health fsa may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end. Web though employers think of fsas as a tax benefit that.

End of Year FSA Information

Web rollover for the 2022 plan year, any remaining balance of up to $570 (minimum $30) in your health care or. Web the american rescue plan act of 2021 also optionally and temporarily increases the annual limit for dc fsas. Web the money contributed to your fsa account must be used during the calendar year and does not carry over..

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Web a health fsa may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end. Web the irs sets fsa and hsa limits based on calendar year. Web the scrip sets fsa and hsa limits based on calendar year. At that point, you still have $150 left.

What is the Difference Between Fiscal Year and Calendar Year

The fsa plan administrator or employer. Our benefit year is 10/1 to 9/30. Web the scrip sets fsa and hsa limits based on calendar year. Web rollover for the 2022 plan year, any remaining balance of up to $570 (minimum $30) in your health care or. Web usually, money that goes unused in an fsa account is forfeited at the.

Fiscal Year vs Calendar Year What's The Difference?

Web in 2023, employees can put away as much as $3,050 in an fsa, an increase of about 7% from the current tax. Web usually, money that goes unused in an fsa account is forfeited at the end of the calendar year (except for the. Web the amount of money employees could carry over to the next calendar year was.

A Flexible Savings Account (FSA) plan allows you to

My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31,. This rule stated that you must. Our benefit year is 10/1 to 9/30. Web in 2023, employees can put away as much as $3,050 in an fsa, an increase of about 7% from the current tax. Web stephen miller, cebs.

Web Usually, Money That Goes Unused In An Fsa Account Is Forfeited At The End Of The Calendar Year (Except For The.

The fsa plan administrator or employer. 31, known as calendar year. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31,. Our benefit year is 10/1 to 9/30.

Web Imagine That Your Plan Year Ends On Dec.

Mployees can put an extra $200 into their health. Web to decide if an fsa is right for you, forecast upcoming health and dependent care expenses for the year, plus general. Web the scrip sets fsa and hsa limits based on calendar year. Web in 2023, employees can put away as much as $3,050 in an fsa, an increase of about 7% from the current tax.

At That Point, You Still Have $150 Left In Unused Funds In Your.

Web a flexible spending account plan year does not have to be based on the calendar year. Web the amount of money employees could carry over to the next calendar year was limited to $550. Our benefit year is 10/1 to 9/30. Web rollover for the 2022 plan year, any remaining balance of up to $570 (minimum $30) in your health care or.

This Rule Stated That You Must.

Web the money contributed to your fsa account must be used during the calendar year and does not carry over. Web the american rescue plan act of 2021 also optionally and temporarily increases the annual limit for dc fsas. Web though employers think of fsas as a tax benefit that should coincide with the tax (calendar) year and the dependent. Web the irs sets fsa and hsa limits based on calendar year.

![[Infographic] Differences Between HSA vs Healthcare FSA Lively](https://images.contentful.com/6j8y907dne6i/4ybuuyj9ezbDGRstgDEu1n/53a3c7d8ed9aaf53a10beb53ffe22249/HSA_vs_FSA_infographic_2022_2x.png)

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)