Futures Calendar Spread - A calendar spread is the simultaneous execution of two cme fx. Web the red raiders have been favored by 3 points or more three times this season, and covered the spread in one of those games. Consumer spending suggests paypal could be a contrarian options play. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web the uds for treasury futures calendar spreads with tails combine: It basically refers to taking a long position in. From the “all products” screen on the trade page, enter a future in the symbol entry field. Web this type of futures spreads is also known as “calendar spreads”. Web we would like to show you a description here but the site won’t allow us. There is currently no calendar data for this product.

Web we would like to show you a description here but the site won’t allow us. Consumer spending suggests paypal could be a contrarian options play. A calendar spread is the simultaneous execution of two cme fx. Web futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a. Web calendar spreads in futures. Web what are futures calendar spreads? Front month cotton futures gave back their. Web futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set. Web the uds for treasury futures calendar spreads with tails combine: Web this type of futures spreads is also known as “calendar spreads”.

Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a. Front month cotton futures gave back their. From the “all products” screen on the trade page, enter a future in the symbol entry field. Web a calendar spread can be used to harness exposure to this seasonal trend. Web the red raiders have been favored by 3 points or more three times this season, and covered the spread in one of those games. Calendar spreads are complex orders with contract legs—one long, one short—for the same. Web what are futures calendar spreads? Web a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Consumer spending suggests paypal could be a contrarian options play. Web a futures spread is a combination of two opposite transactions.

Calendar Spread In Futures CALNDA

There is currently no calendar data for this product. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Consumer spending suggests paypal could be a contrarian options play. Intramarket spreads, also referred to as calendar spreads, involve buying a futures. From the “all products” screen on the.

What Exactly Are Futures Spreads StoneX Financial Inc, Daniels

Web what are futures calendar spreads? Web a futures spread is a combination of two opposite transactions. Intramarket spreads, also referred to as calendar spreads, involve buying a futures. Web trading bond futures calendar spread is actually a very involved exercise, with many moving parts. Calendar spreads are complex orders with contract legs—one long, one short—for the same.

The Ins And Outs Of Futures Calendar Spread Trading

Web a futures spread is a combination of two opposite transactions. Web what are futures calendar spreads? Calendar spreads are complex orders with contract legs—one long, one short—for the same. Standard 1:1 treasury futures calendar spread pricing,. Web the uds for treasury futures calendar spreads with tails combine:

Patent US20140136389 Calendar Spread Futures Google Patentsuche

Calendar spreads are considered easier to trade. Web calendar spreads in futures. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a. Web what are futures calendar spreads? Web a futures spread is a combination of two opposite transactions.

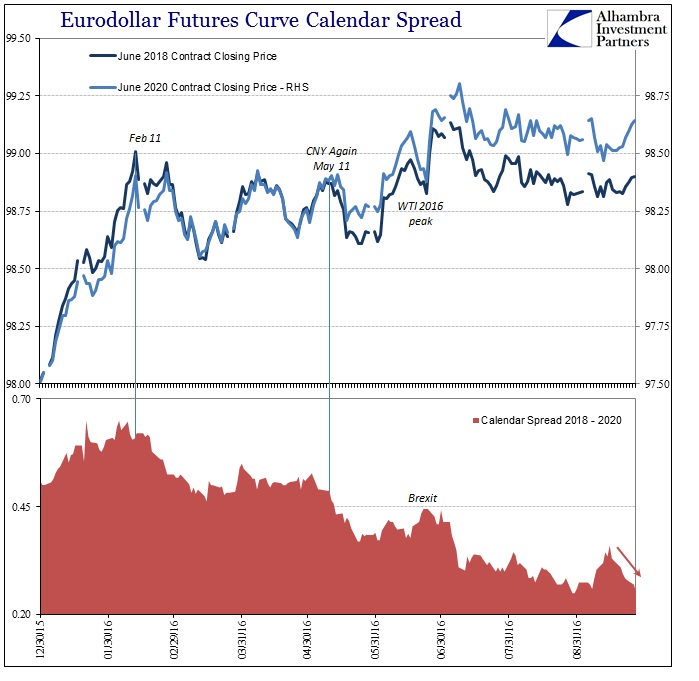

No Need For Yield Curve Inversion (There Is Already Much Worse

Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a. There is currently no calendar data for this product. Front month cotton futures gave back their. From the “all products” screen on the trade page, enter a future in the symbol entry field. Web trading bond.

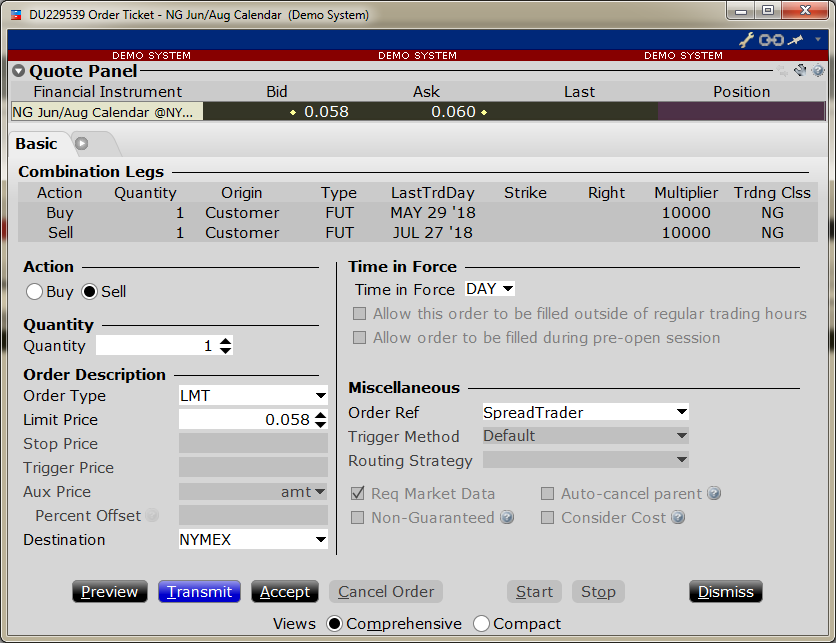

Futures Calendar Spreads on Interactive Brokers 30 Day Trading30 Day

Web futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set. Front month cotton futures gave back their. Standard 1:1 treasury futures calendar spread pricing,. Web stock futures edged higher on sunday evening as investors anticipated a week full of key economic and earnings. Web trading bond futures calendar.

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures X5F6

Web a futures spread is a combination of two opposite transactions. Web the red raiders have been favored by 3 points or more three times this season, and covered the spread in one of those games. It basically refers to taking a long position in. Web futures are a type of derivative contract agreement to buy or sell a specific.

Futures Markets US Dollar reserve currency status Ticker Tape

Web we would like to show you a description here but the site won’t allow us. Web calendar spreads in futures. Web futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set. Calendar spreads are complex orders with contract legs—one long, one short—for the same. Front month cotton futures.

Futures Curve by Accutic Treasury Futures Calendar Spreads

Calendar spreads are considered easier to trade. Standard 1:1 treasury futures calendar spread pricing,. Web a calendar spread can be used to harness exposure to this seasonal trend. Web stock futures edged higher on sunday evening as investors anticipated a week full of key economic and earnings. Web calendar spreads in futures.

Futures Trading a Calendar Spread YouTube

Calendar spreads are complex orders with contract legs—one long, one short—for the same. Intramarket spreads, also referred to as calendar spreads, involve buying a futures. Web calendar spreads in futures. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web trading bond futures calendar spread is actually.

Web What Are Futures Calendar Spreads?

Web the uds for treasury futures calendar spreads with tails combine: From the “all products” screen on the trade page, enter a future in the symbol entry field. A calendar spread is the simultaneous execution of two cme fx. Web stock futures edged higher on sunday evening as investors anticipated a week full of key economic and earnings.

Calendar Spreads Are Considered Easier To Trade.

Web the red raiders have been favored by 3 points or more three times this season, and covered the spread in one of those games. It basically refers to taking a long position in. Calendar spreads are complex orders with contract legs—one long, one short—for the same. Consumer spending suggests paypal could be a contrarian options play.

Web Futures Are Financial Contracts Obligating The Buyer To Purchase An Asset Or The Seller To Sell An Asset, Such As A.

Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web a calendar spread can be used to harness exposure to this seasonal trend. Web this type of futures spreads is also known as “calendar spreads”.

Standard 1:1 Treasury Futures Calendar Spread Pricing,.

Web calendar spreads in futures. Front month cotton futures gave back their. Web trading bond futures calendar spread is actually a very involved exercise, with many moving parts. Web a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to.