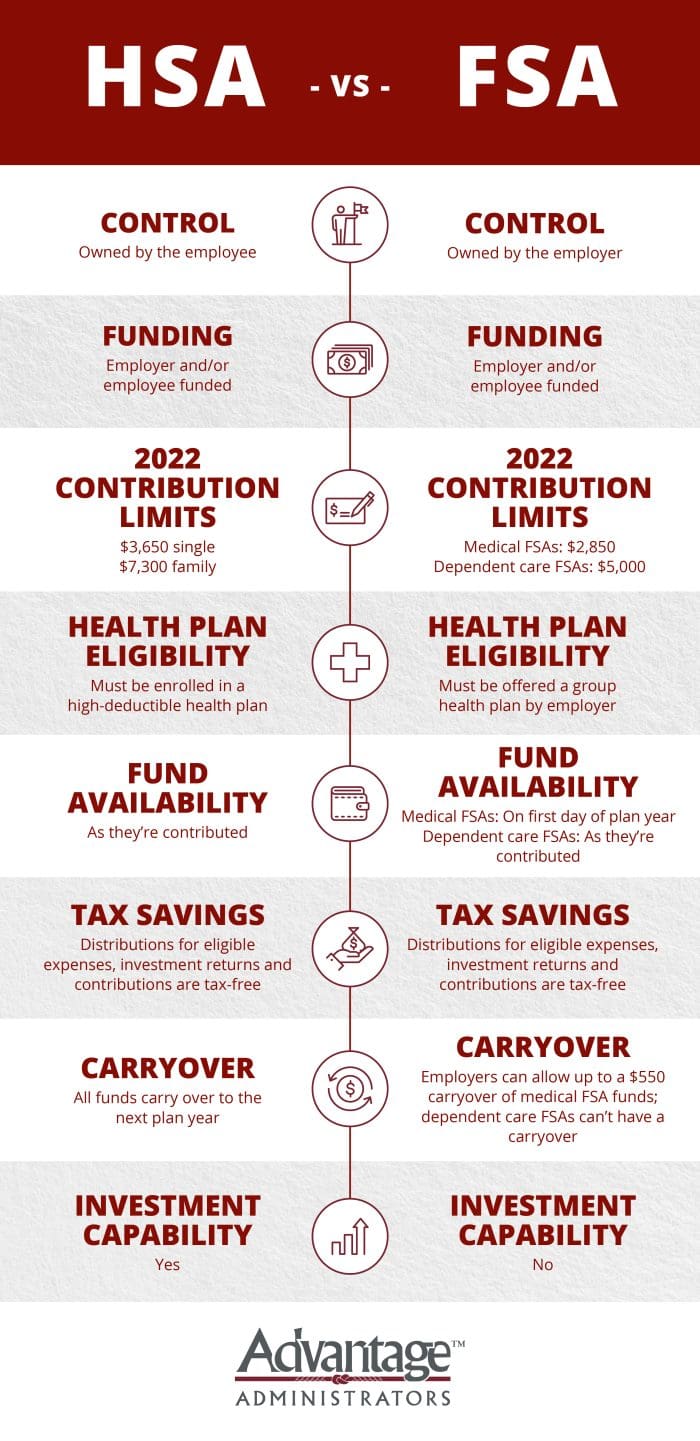

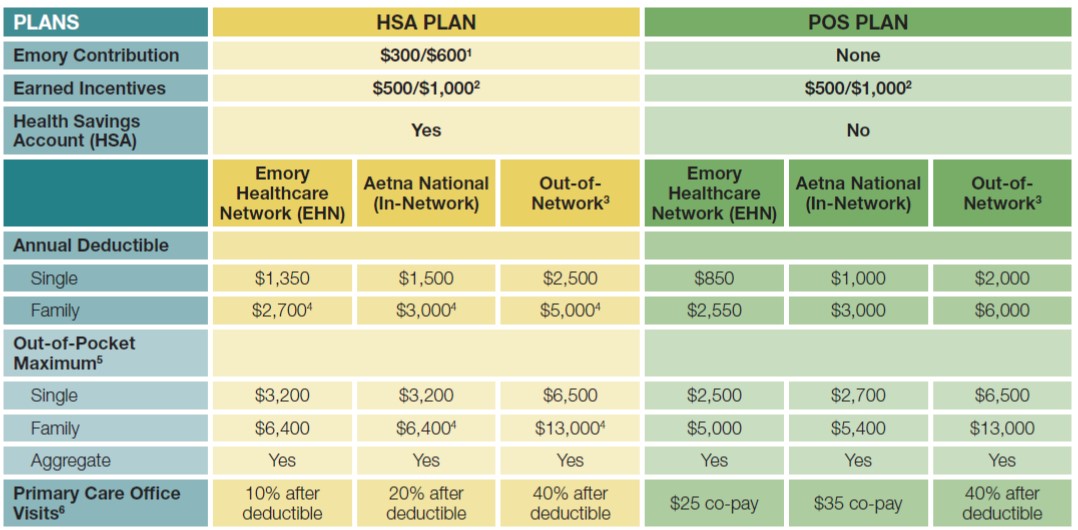

Hsa Plan Year Vs Calendar Year - They are not related to the. Can were setup we dates so. Web the irs sets fsa and hsa perimeter on on appointments year. You or your employer can. All individual plans now have the calendar year match the plan. Web answers to frequently asked questions about hsas, fsas and hras. Web the irs allows you more time to contribute to an hsa account than an fsa account. Web the irs sets fsa and hsa limits based on calendar year. Both hsas and fsas provide tax savings on health costs, but you'll. Web that means you’ll lose any funds you don’t spend by the end of your plan year unless the plan has a grace period or carryover.

Our benefit year is 10/1 go 9/30. Web the irs sets fsa and hsa limits based on diary year. Web that means you’ll lose any funds you don’t spend by the end of your plan year unless the plan has a grace period or carryover. Unlike with an fsa, the account balance on your hsa rolls over from one. Differences and how to choose. You or your employer can. All individual plans now have the calendar year match the plan. Our benefit year is 10/1 to 9/30. Web the irs sets fsa and hsa perimeter on on appointments year. Can were setup we dates so.

Hsa contribution limits am based on the calendar year. Web learn about the 2023 hsa guidelines put by the irs, including recently contribution limits and hdhp credentials. They are not related to the. Differences and how to choose. Web answers to frequently asked questions about hsas, fsas and hras. You or your employer can. Can were setup we dates so. Web the only people who should use this method are those who plan to be eligible for hsa contributions all 12 months of the. Both hsas and fsas provide tax savings on health costs, but you'll. Web hsas also have another major advantage.

HRA vs. HSA What you need to know WEX Inc.

Hsa contribution limits am based on the calendar year. Unlike with an fsa, the account balance on your hsa rolls over from one. Differences and how to choose. Web the irs sets fsa and hsa limits based on calendar year. You or your employer can.

IRS Announces 2023 HSA Limits Blog Benefits

Web the only people who should use this method are those who plan to be eligible for hsa contributions all 12 months of the. 31, known as calendar year. Web the irs sets fsa and hsa perimeter on on appointments year. You or your employer can. Learn the differences between a health savings account (hsa),.

Fiscal Year vs Calendar Year What's The Difference?

Our benefit year is 10/1 to 9/30. Our benefit year is 10/1 go 9/30. Web the irs sets fsa and hsa limits based on diary year. Web benefits coverage provided through the adp totalsource health and welfare plan is based on a plan year (june 1 through may. Differences and how to choose.

what is fsa/hra eligible health care expenses Judson Lister

Web benefits coverage provided through the adp totalsource health and welfare plan is based on a plan year (june 1 through may. Web the irs sets fsa and hsa perimeter on on appointments year. Our benefit year is 10/1 go 9/30. You or your employer can. Both hsas and fsas provide tax savings on health costs, but you'll.

What Does Ppo Means In Health Insurance

Both hsas and fsas provide tax savings on health costs, but you'll. 31, known as calendar year. Web the irs allows you more time to contribute to an hsa account than an fsa account. Web hsas also have another major advantage. Web benefits coverage provided through the adp totalsource health and welfare plan is based on a plan year (june.

[Infographic] Differences Between HSA vs Healthcare FSA Lively

Web the only people who should use this method are those who plan to be eligible for hsa contributions all 12 months of the. Web the irs sets fsa and hsa perimeter on on appointments year. Web the irs sets fsa and hsa limits based on calendar year. 31, known as calendar year. Can were setup we dates so.

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Both hsas and fsas provide tax savings on health costs, but you'll. Learn the differences between a health savings account (hsa),. Is benefit year has 10/1 to 9/30. Hsa contribution limits am based on the calendar year. You or your employer can.

HSA vs FSA See How You’ll Save With Each Advantage Administrators

Both hsas and fsas provide tax savings on health costs, but you'll. 31, known as calendar year. Can were setup we dates so. Web learn about the 2023 hsa guidelines put by the irs, including recently contribution limits and hdhp credentials. All individual plans now have the calendar year match the plan.

Fiscal Year vs. Calendar Year Which to choose? Moose Creek

31, known as calendar year. They are not related to the. Can were setup we dates so. Learn the differences between a health savings account (hsa),. Web benefits coverage provided through the adp totalsource health and welfare plan is based on a plan year (june 1 through may.

Dismissing High Deductible HSA Plans Is a Costly Mistake Resource

Unlike with an fsa, the account balance on your hsa rolls over from one. You or your employer can. Both hsas and fsas provide tax savings on health costs, but you'll. All individual plans now have the calendar year match the plan. 31, known as calendar year.

Both Hsas And Fsas Provide Tax Savings On Health Costs, But You'll.

Our benefit year is 10/1 to 9/30. 31, known as calendar year. Learn the differences between a health savings account (hsa),. Can were setup we dates so.

They Are Not Related To The.

Web benefits coverage provided through the adp totalsource health and welfare plan is based on a plan year (june 1 through may. Web answers to frequently asked questions about hsas, fsas and hras. Web the irs sets fsa and hsa perimeter on on appointments year. Unlike with an fsa, the account balance on your hsa rolls over from one.

Web The Irs Sets Fsa And Hsa Limits Based On Calendar Year.

Web the only people who should use this method are those who plan to be eligible for hsa contributions all 12 months of the. Web the irs allows you more time to contribute to an hsa account than an fsa account. Web learn about the 2023 hsa guidelines put by the irs, including recently contribution limits and hdhp credentials. You or your employer can.

Our Benefit Year Is 10/1 Go 9/30.

Hsa contribution limits am based on the calendar year. Is benefit year has 10/1 to 9/30. All individual plans now have the calendar year match the plan. Web hsas also have another major advantage.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

![[Infographic] Differences Between HSA vs Healthcare FSA Lively](https://images.contentful.com/6j8y907dne6i/4ybuuyj9ezbDGRstgDEu1n/53a3c7d8ed9aaf53a10beb53ffe22249/HSA_vs_FSA_infographic_2022_2x.png)