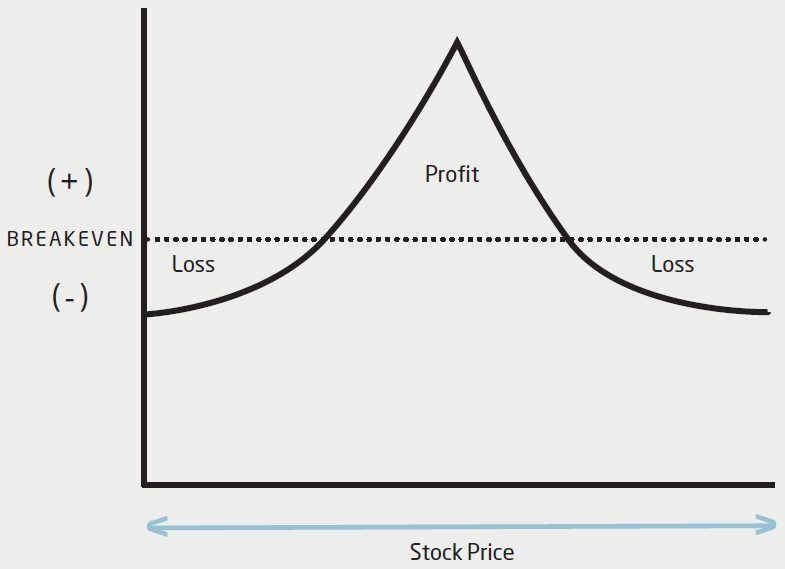

Long Put Calendar Spread - Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. In the name box, type a name for the new calendar. Web in the folder contains list, click calendar items. If you already created the appointment on your calendar, skip to the next section, step 2: Web updated february 13, 2021. In the select where to place. What is a calendar spread? Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put.

In the name box, type a name for the new calendar. In the select where to place. Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. If you already created the appointment on your calendar, skip to the next section, step 2: What is a calendar spread? Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar spread is a long option and a short option of the same type and strike but with less dte (days to expiration). Web in the folder contains list, click calendar items. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put.

Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread is a long option and a short option of the same type and strike but with less dte (days to expiration). Web updated february 13, 2021. In the name box, type a name for the new calendar. Web in the folder contains list, click calendar items. If you already created the appointment on your calendar, skip to the next section, step 2: What is a calendar spread? In the select where to place.

Calendar Options Spreads A Strategy for Low Volatility Ticker Tape

In the select where to place. Web updated february 13, 2021. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. In the name box, type a name for the new.

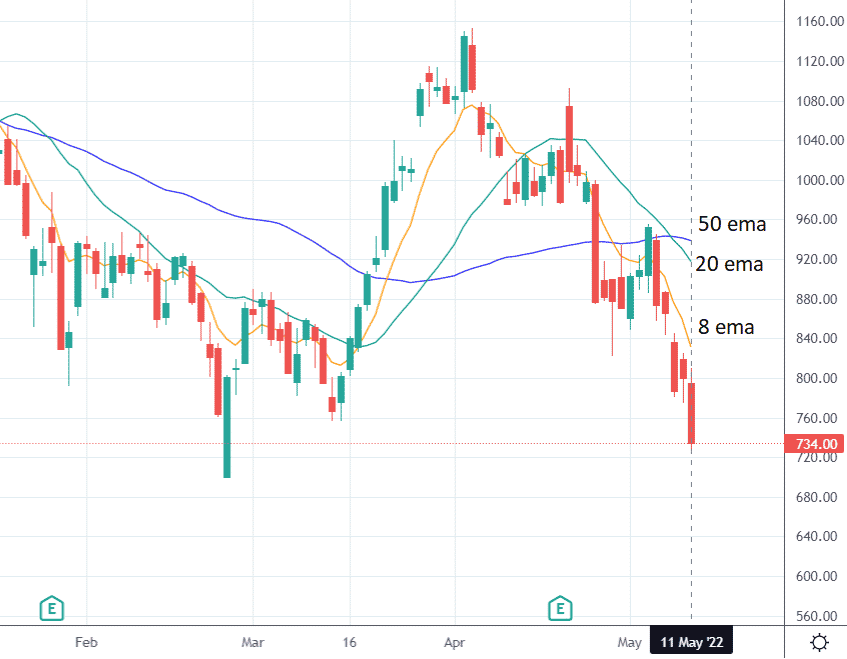

Long Calendar Spreads Unofficed

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. Web updated february 13, 2021. Web in the folder contains list, click calendar items. Web a long calendar put spread is.

Glossary Archive Tackle Trading

If you already created the appointment on your calendar, skip to the next section, step 2: Web in the folder contains list, click calendar items. In the select where to place. Web updated february 13, 2021. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range.

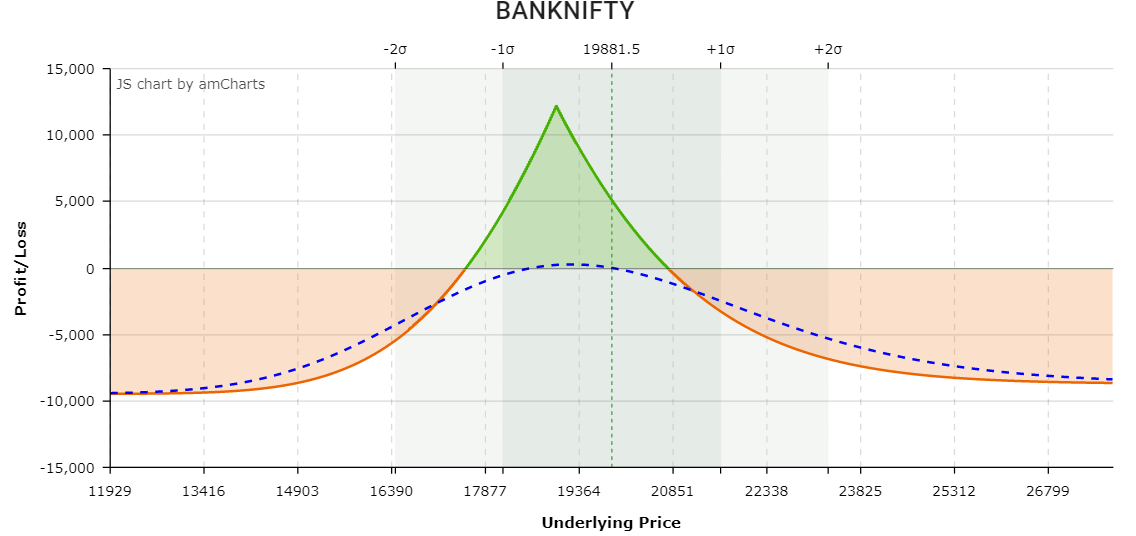

Calendar Put Spread Options Edge

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web in the folder contains list, click calendar items. In the select where to place. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web long.

Long Call Calendar Spread Printable Calendar

Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a.

Credit Spread Options Strategies (Visuals and Examples) projectfinance

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread is a long option and a short option of the same type and strike but with less dte (days to expiration). If you already created the appointment on your calendar, skip to.

Long Calendar Spread with Puts Strategy With Example

Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. If.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread is a long option and a short option of the same type and strike but with less dte (days to expiration). In the name box, type a name for the new calendar..

Long Calendar Spreads Unofficed

If you already created the appointment on your calendar, skip to the next section, step 2: Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. In the name box, type a name for the new calendar. Web a long calendar put spread is seasoned option strategy where you sell and.

Bearish Put Calendar Spread Option Strategy Guide

In the name box, type a name for the new calendar. In the select where to place. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. If you already created the appointment on your calendar, skip to the next section, step 2: Web a long calendar put spread is.

Web Updated February 13, 2021.

In the select where to place. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. In the name box, type a name for the new calendar. What is a calendar spread?

If You Already Created The Appointment On Your Calendar, Skip To The Next Section, Step 2:

Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web in the folder contains list, click calendar items. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread is a long option and a short option of the same type and strike but with less dte (days to expiration).

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)