Reverse Calendar Spread - Web click here to download a copy of the 2021 neighbors reverse lenten calendar and start your own donation. Web reverse calendar spread. A reverse calendar spread can be created by reversing the transactions that take place in a regular. Web a calendar spread is a long or short position in the stock with the same strike price and different expiration dates. Web a reverse calendar spread option strategy is an advanced option strategy that involves simultaneous. The handbook of international financial terms author(s): Web the calendar spread can be used in two ways: As a typical calendar when volatility is low or as a reverse calendar. Web the reverse calendar spread is similar to a traditional call spread or put spread except it uses one strike price. Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and.

Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. Web the calendar spread can be used in two ways: An option or futures spread which reverses a regular calendar spread. As a typical calendar when volatility is low or as a reverse calendar. A reverse calendar spread can be created by reversing the transactions that take place in a regular. Web click here to download a copy of the 2021 neighbors reverse lenten calendar and start your own donation. Web a reverse calendar spread option strategy is an advanced option strategy that involves simultaneous. The handbook of international financial terms author(s): Web reverse calendar spread. Web the reverse calendar spread is similar to a traditional call spread or put spread except it uses one strike price.

The handbook of international financial terms author(s): Web a reverse calendar spread option strategy is an advanced option strategy that involves simultaneous. Web a calendar spread is a long or short position in the stock with the same strike price and different expiration dates. As a typical calendar when volatility is low or as a reverse calendar. An option or futures spread which reverses a regular calendar spread. Web the calendar spread can be used in two ways: Web the reverse calendar spread is similar to a traditional call spread or put spread except it uses one strike price. Web reverse calendar spread. A reverse calendar spread can be created by reversing the transactions that take place in a regular. Web click here to download a copy of the 2021 neighbors reverse lenten calendar and start your own donation.

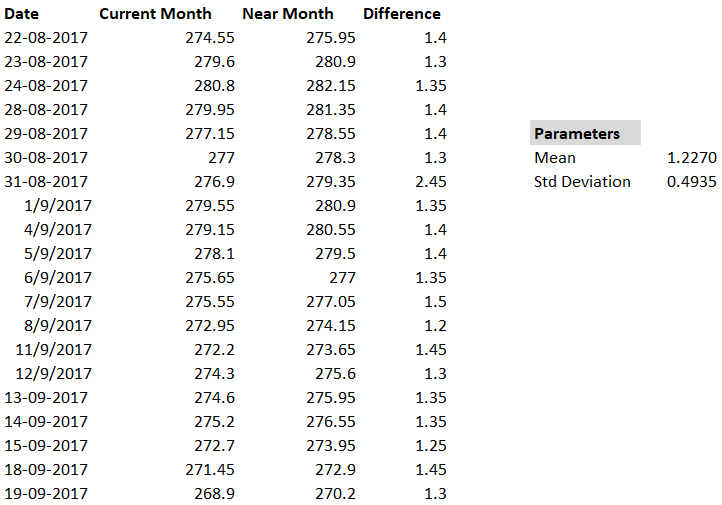

Calendar Spreads Varsity by Zerodha

Web a calendar spread is a long or short position in the stock with the same strike price and different expiration dates. Web a reverse calendar spread option strategy is an advanced option strategy that involves simultaneous. The handbook of international financial terms author(s): An option or futures spread which reverses a regular calendar spread. Web reverse calendar spread.

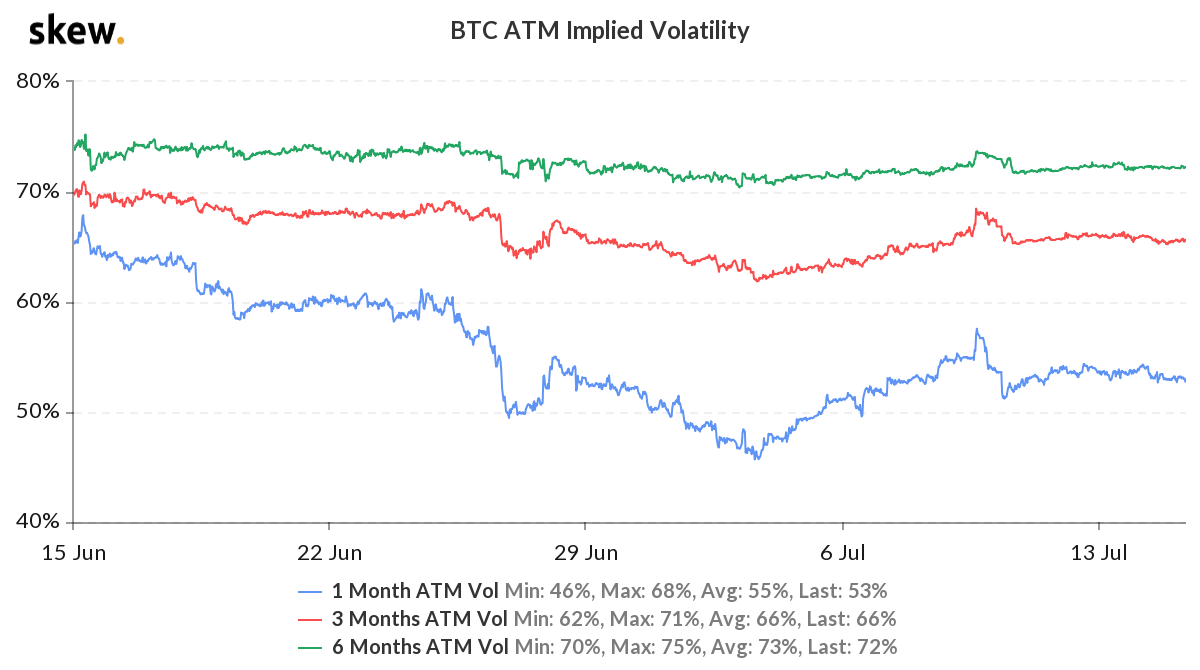

How To Trade Vega At Market Bottoms Evil Speculator

Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. The handbook of international financial terms author(s): Web the reverse calendar spread is similar to a traditional call spread or put spread except it uses one strike price. Web the calendar spread can be used in two ways: An option or.

Volatility Convergence, Reverse Calendar Spread for TVCVIX by

A reverse calendar spread can be created by reversing the transactions that take place in a regular. The handbook of international financial terms author(s): An option or futures spread which reverses a regular calendar spread. Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. Web click here to download a.

Pin on Double Calendar Spreads and Adjustments

Web the calendar spread can be used in two ways: Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. An option or futures spread which reverses a regular calendar spread. Web reverse calendar spread. Web a calendar spread is a long or short position in the stock with the same.

CBOE Volatility Index Futures Reverse Calendar Spreads

Web reverse calendar spread. A reverse calendar spread can be created by reversing the transactions that take place in a regular. As a typical calendar when volatility is low or as a reverse calendar. The handbook of international financial terms author(s): Web a calendar spread is a long or short position in the stock with the same strike price and.

Greeks.Live & Deribit Options Market Observation 0715 — Reverse

An option or futures spread which reverses a regular calendar spread. Web reverse calendar spread. A reverse calendar spread can be created by reversing the transactions that take place in a regular. Web the calendar spread can be used in two ways: Web a reverse calendar spread option strategy is an advanced option strategy that involves simultaneous.

Reverse Calendar Spread using Call Options YouTube

A reverse calendar spread can be created by reversing the transactions that take place in a regular. As a typical calendar when volatility is low or as a reverse calendar. Web a reverse calendar spread option strategy is an advanced option strategy that involves simultaneous. Web click here to download a copy of the 2021 neighbors reverse lenten calendar and.

Calendar Put Spread Options Edge

The handbook of international financial terms author(s): Web the calendar spread can be used in two ways: An option or futures spread which reverses a regular calendar spread. Web a reverse calendar spread option strategy is an advanced option strategy that involves simultaneous. As a typical calendar when volatility is low or as a reverse calendar.

Calendar Spread Strategy How To Make Adjustments YouTube

Web the reverse calendar spread is similar to a traditional call spread or put spread except it uses one strike price. An option or futures spread which reverses a regular calendar spread. Web click here to download a copy of the 2021 neighbors reverse lenten calendar and start your own donation. As a typical calendar when volatility is low or.

Reverse Calendar Spread AwesomeFinTech Blog

Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. Web click here to download a copy of the 2021 neighbors reverse lenten calendar and start your own donation. Web the reverse calendar spread is similar to a traditional call spread or put spread except it uses one strike price. Web.

A Reverse Calendar Spread Can Be Created By Reversing The Transactions That Take Place In A Regular.

Web the calendar spread is a strategy that involves purchasing one option which expires further in the future and. Web a reverse calendar spread option strategy is an advanced option strategy that involves simultaneous. As a typical calendar when volatility is low or as a reverse calendar. Web reverse calendar spread.

Web The Reverse Calendar Spread Is Similar To A Traditional Call Spread Or Put Spread Except It Uses One Strike Price.

The handbook of international financial terms author(s): Web click here to download a copy of the 2021 neighbors reverse lenten calendar and start your own donation. Web the calendar spread can be used in two ways: Web a calendar spread is a long or short position in the stock with the same strike price and different expiration dates.