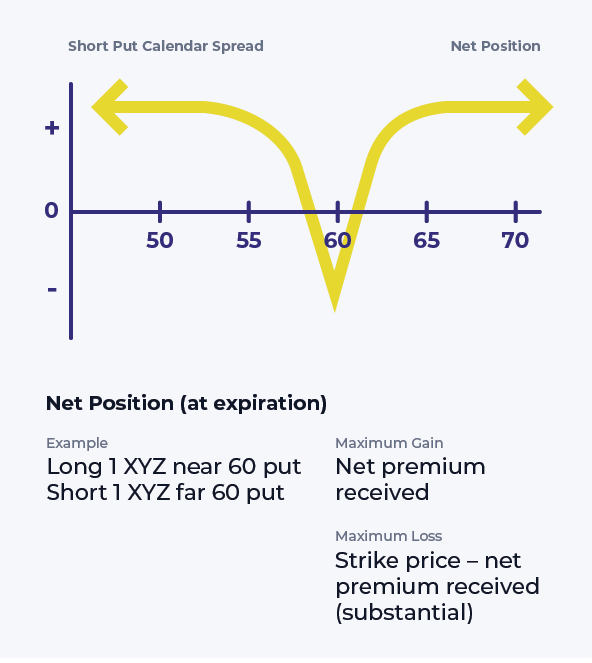

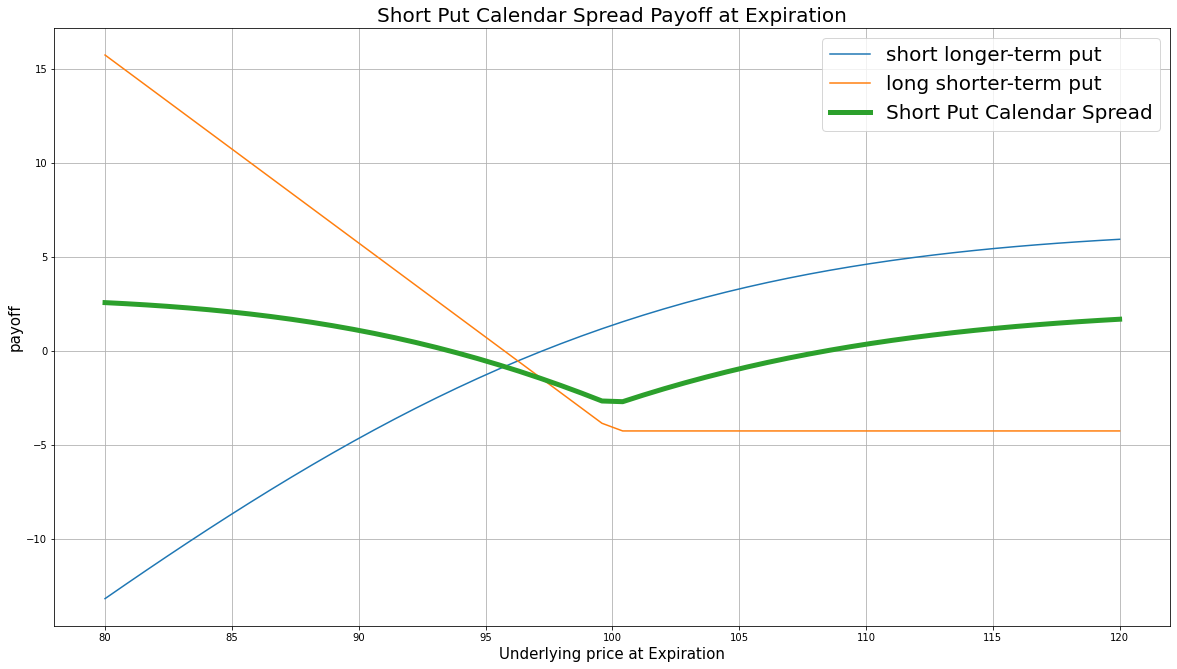

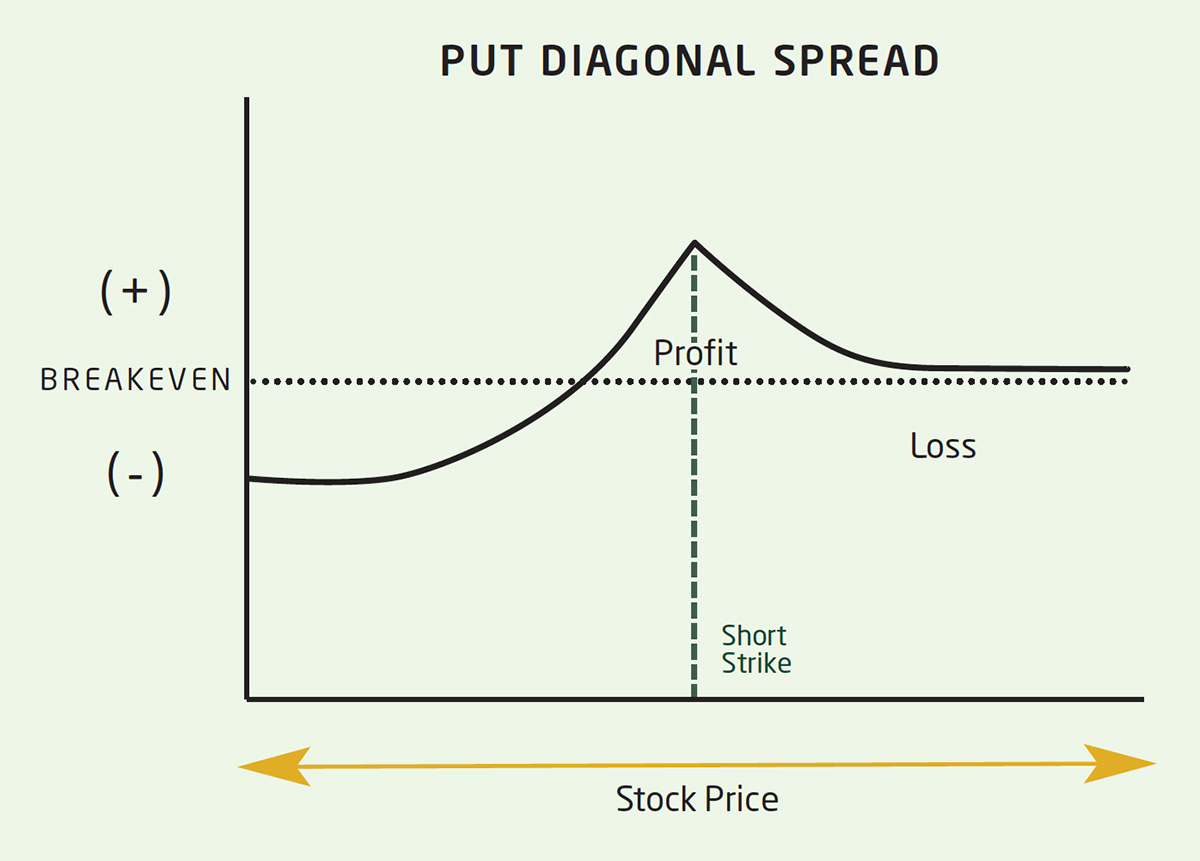

Short Put Calendar Spread - Web a calendar spread is a type of horizontal spread. 3.4k views 2 years ago options market. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Buying one put option and selling a second put option with a more distant expiration is an example of a short. Web selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. If you’re unfamiliar with a horizontal spread, it’s an options strategy. Web a short calendar put spread is an options trading strategy that involves buying and selling two sets of puts with. Web bear put debit spreads; Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.

If you’re unfamiliar with a horizontal spread, it’s an options strategy. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. 3.4k views 2 years ago options market. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. Buying one put option and selling a second put option with a more distant expiration is an example of a short. In this video i have explained about short put calendar spread. Web bear put debit spreads; Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are. Web a short calendar put spread is an options trading strategy that involves buying and selling two sets of puts with.

3.4k views 2 years ago options market. Buying one put option and selling a second put option with a more distant expiration is an example of a short. Web a short put calendar spread is another type of spread that uses two different put options. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. Web bear put debit spreads; If you’re unfamiliar with a horizontal spread, it’s an options strategy. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Buying one put option and selling a second put option with a more distant expiration is an example of a short. Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are.

Short Put Calendar Spread Options Strategy

In this video i have explained about short put calendar spread. Web a short calendar put spread is an options trading strategy that involves buying and selling two sets of puts with. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a calendar spread is a type of.

Put Calendar Spread

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a short put calendar spread is another type of spread that uses two different put options. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web the short calendar put.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Buying one put option and selling a second put option with a more distant expiration is an example of a short. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. If you’re unfamiliar with a horizontal spread, it’s an options strategy. Web the short calendar call.

Special Focus Spread Trading // Building a Better Mo... Ticker Tape

Buying one put option and selling a second put option with a more distant expiration is an example of a short. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. Web short put calendar spread (short put time spread) this strategy profits from.

Short Put Calendar Short put calendar Spread Reverse Calendar

Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are. If you’re unfamiliar with a horizontal spread, it’s an options strategy. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web short.

Glossary Archive Tackle Trading

Buying one put option and selling a second put option with a more distant expiration is an example of a short. Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are. Web a calendar spread is a type of horizontal spread. Web a calendar spread is.

Calendar Put Spread Options Edge

Web a short put calendar spread is another type of spread that uses two different put options. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. Buying one put option and selling a second put option with a more distant expiration is an.

Pin on CALENDAR SPREADS OPTIONS

If you’re unfamiliar with a horizontal spread, it’s an options strategy. 3.4k views 2 years ago options market. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Buying one put option and selling a second put option with a more distant expiration is an example of a short. Web.

Using Calendar Trading and Spread Option Strategies

Buying one put option and selling a second put option with a more distant expiration is an example of a short. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a short put calendar spread is another type of spread that uses two different put.

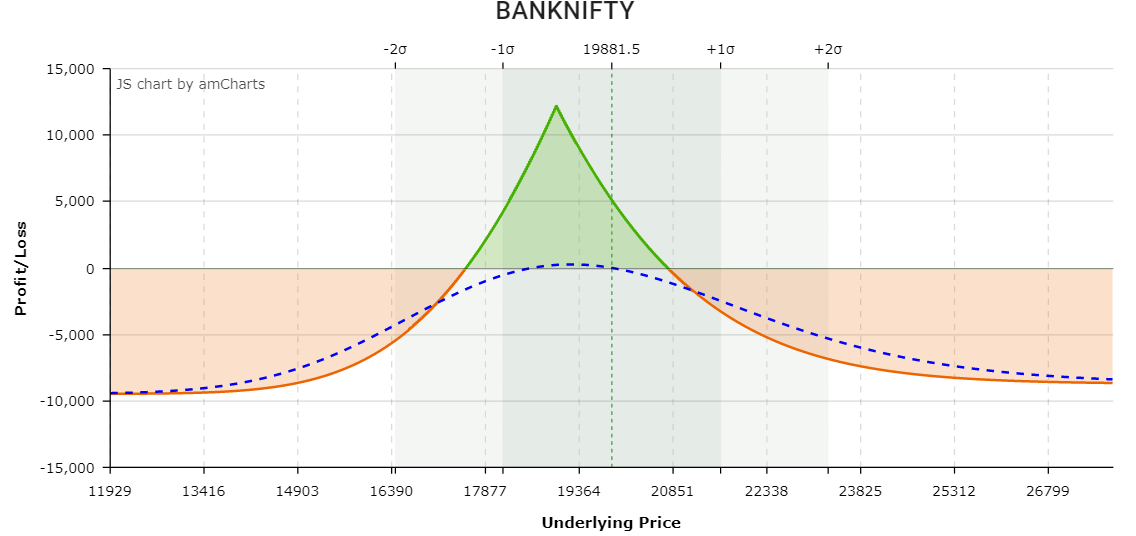

Long Calendar Spreads Unofficed

3.4k views 2 years ago options market. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Buying one put option.

Web A Short Calendar Put Spread Is An Options Trading Strategy That Involves Buying And Selling Two Sets Of Puts With.

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. Web bear put debit spreads;

Web Selling A Call Calendar Spread Consists Of Buying One Call Option And Selling A Second Call Option With A More Distant Expiration.

Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are. Buying one put option and selling a second put option with a more distant expiration is an example of a short. Buying one put option and selling a second put option with a more distant expiration is an example of a short. In this video i have explained about short put calendar spread.

Web A Short Put Calendar Spread Is Another Type Of Spread That Uses Two Different Put Options.

Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. If you’re unfamiliar with a horizontal spread, it’s an options strategy. 3.4k views 2 years ago options market. Web a calendar spread is a type of horizontal spread.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Calendar_Trading_and_Spread_Option_Strategies_Nov_2020-01-b1d47a55f4684e1b9d37580d219dc778.jpg)