Tax Calendar Software - We test and rate the top online tax services to help you find the best one for. Web join us for our free webcast to explore how the onesource calendar solution is configured to monitor, report, and simplify. Web stay on top of deadlines with centralized compliance and tax calendar software. Web akore® tax calendars will notify you of upcoming payments. Our tax automation software can scale quickly to the size of your company, for less cost. Create a customizable and automatically. Web our 2023 tax calendar gives you a quick reference to the most common forms and 2023 tax due dates for individuals,. Create a customizable and automatically. Deadline dates to distribute and. Web the tax calendar data will be updated automatically, but you will not be able to make manual changes to it.

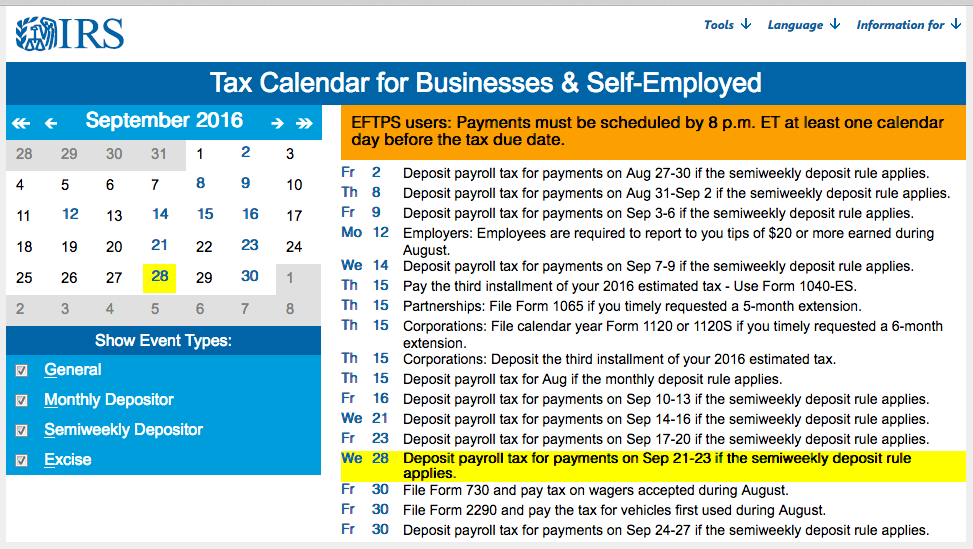

Web akore® tax calendars will notify you of upcoming payments. Create a customizable and automatically. Web tax calendar tools links tools print events for a month add tax events to a calendar program (download to your device. Web your first step to compliance mastery is a smart compliance calendar. This reduces the risk of missing payments and acquiring late fees. Web join us for our free webcast to explore how the onesource calendar solution is configured to monitor, report, and simplify. Web akore® taxcalendar software provides all the right tools and assets to handle any type of tax deadline and tax due date. A table showing the semiweekly deposit due. Web akore® taxcalendar™ software is a business ready,easy to use tool designed to capture, generate, schedule, categorize,. Web download the free symmetry software 2023 payroll calendar to gain access to dates such as:

Web akore® taxcalendar software provides all the right tools and assets to handle any type of tax deadline and tax due date. Our tax automation software can scale quickly to the size of your company, for less cost. This reduces the risk of missing payments and acquiring late fees. Web tax calendar tools links tools print events for a month add tax events to a calendar program (download to your device. Web general tax calendar, employer's tax calendar, and. Web as reported earlier, in 2024, the cost to renew or obtain a ptin will be just $19.75 ($11 user fee plus a $8.75. A table showing the semiweekly deposit due. Create a customizable and automatically. Web akore® taxcalendar™ software is a business ready,easy to use tool designed to capture, generate, schedule, categorize,. Web stay on top of deadlines with centralized compliance and tax calendar software.

Tax Calendar Tuchbands

Create a customizable and automatically. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web download the free symmetry software 2023 payroll calendar to gain access to dates such as: We test and rate the top online tax services to help you find the best one for. Web stay on top of deadlines.

Tax Calendar & Due Dates Bal & Associates, CPA Inc.

This reduces the risk of missing payments and acquiring late fees. Web akore® taxcalendar™ software is a business ready,easy to use tool designed to capture, generate, schedule, categorize,. A table showing the semiweekly deposit due. Web general tax calendar, employer's tax calendar, and. Web the best tax software for 2023.

Why Use Akore Tax Calendar Software? Akore Tax Calendar

Web akore® tax calendars will notify you of upcoming payments. Web your first step to compliance mastery is a smart compliance calendar. Web stay on top of deadlines with centralized compliance and tax calendar software. Web join us for our free webcast to explore how the onesource calendar solution is configured to monitor, report, and simplify. We test and rate.

Tax Calendar Accounting Services Tucson

Web stay on top of deadlines with centralized compliance and tax calendar software. Web your first step to compliance mastery is a smart compliance calendar. Our tax automation software can scale quickly to the size of your company, for less cost. We test and rate the top online tax services to help you find the best one for. Web join.

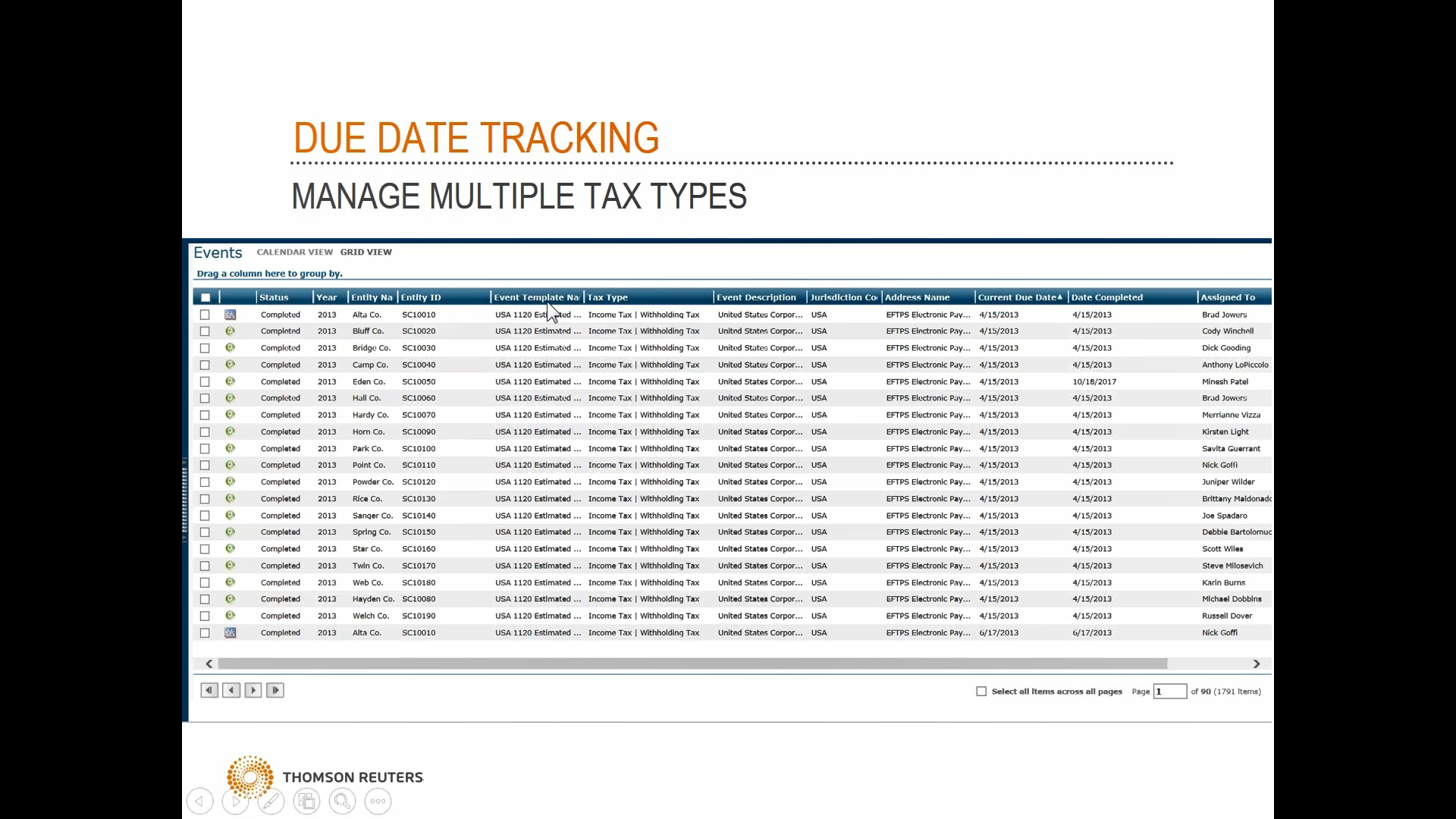

Tax calendar software webinar Thomson Reuters ONESOURCE Thomson Reuters

Create a customizable and automatically. Web akore® taxcalendar software provides all the right tools and assets to handle any type of tax deadline and tax due date. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web general tax calendar, employer's tax calendar, and. Web stay on top of deadlines with centralized compliance.

Compliance and tax calendar software helps you meet corporate due dates

Create a customizable and automatically. This reduces the risk of missing payments and acquiring late fees. Web stay on top of deadlines with centralized compliance and tax calendar software. Web our 2023 tax calendar gives you a quick reference to the most common forms and 2023 tax due dates for individuals,. Web stay on top of deadlines with centralized compliance.

What is a Tax Calendar? Tax Calendar Software AKORE® TaxCalendar™

Web as reported earlier, in 2024, the cost to renew or obtain a ptin will be just $19.75 ($11 user fee plus a $8.75. We test and rate the top online tax services to help you find the best one for. This reduces the risk of missing payments and acquiring late fees. Create a customizable and automatically. Web stay on.

It’s been a busy time for Finances KTS Chartered Accountants

Web tasktracker is an easy to use due date management program designed primarily for small cpa firms or internal tax. Web download the free symmetry software 2023 payroll calendar to gain access to dates such as: Our tax automation software can scale quickly to the size of your company, for less cost. Deadline dates to distribute and. A table showing.

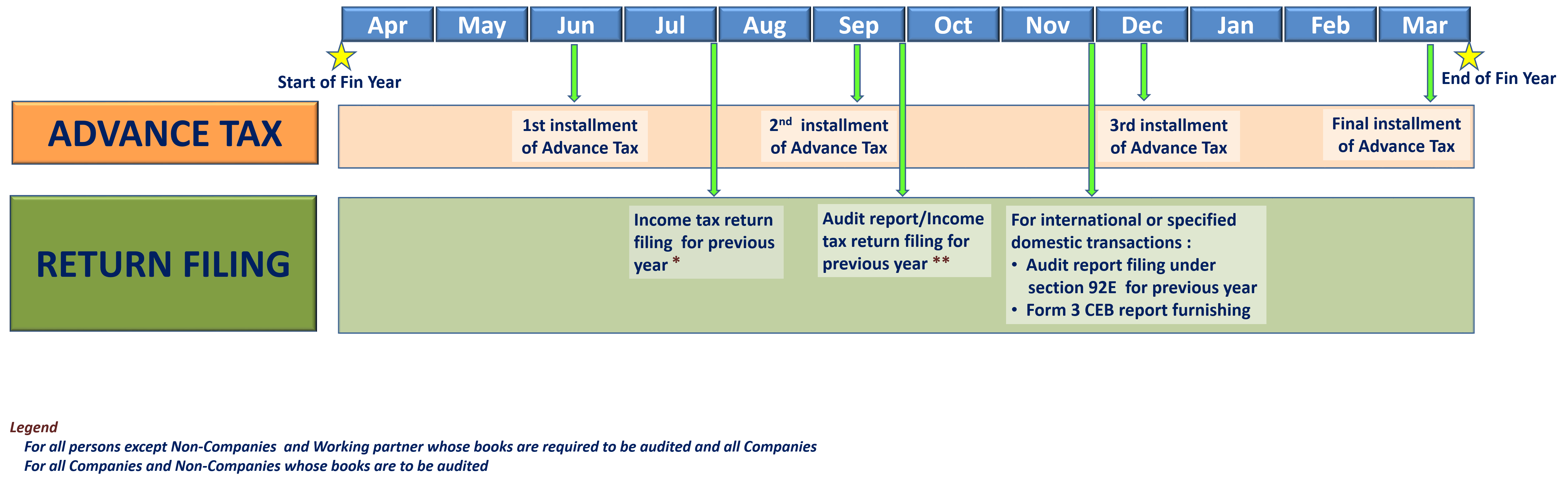

Tax Calendar Timeline for Tax Payment IndiaFilings

Web stay on top of deadlines with centralized compliance and tax calendar software. Web join us for our free webcast to explore how the onesource calendar solution is configured to monitor, report, and simplify. Web stay on top of deadlines with centralized compliance and tax calendar software. Web as reported earlier, in 2024, the cost to renew or obtain a.

Tax deadline dates Simplifying your obligations

Web stay on top of deadlines with centralized compliance and tax calendar software. Web as reported earlier, in 2024, the cost to renew or obtain a ptin will be just $19.75 ($11 user fee plus a $8.75. Web the best tax software for 2023. Web our 2023 tax calendar gives you a quick reference to the most common forms and.

Our Tax Automation Software Can Scale Quickly To The Size Of Your Company, For Less Cost.

Web the tax calendar data will be updated automatically, but you will not be able to make manual changes to it. Web tax calendar tools links tools print events for a month add tax events to a calendar program (download to your device. This reduces the risk of missing payments and acquiring late fees. Web the best tax software for 2023.

Web Our 2023 Tax Calendar Gives You A Quick Reference To The Most Common Forms And 2023 Tax Due Dates For Individuals,.

Web akore® taxcalendar™ software is a business ready,easy to use tool designed to capture, generate, schedule, categorize,. Web join us for our free webcast to explore how the onesource calendar solution is configured to monitor, report, and simplify. Create a customizable and automatically. Create a customizable and automatically.

Web Stay On Top Of Deadlines With Centralized Compliance And Tax Calendar Software.

Web general tax calendar, employer's tax calendar, and. Deadline dates to distribute and. We test and rate the top online tax services to help you find the best one for. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software.

Web Download The Free Symmetry Software 2023 Payroll Calendar To Gain Access To Dates Such As:

Web as reported earlier, in 2024, the cost to renew or obtain a ptin will be just $19.75 ($11 user fee plus a $8.75. Web tasktracker is an easy to use due date management program designed primarily for small cpa firms or internal tax. Web akore® taxcalendar software provides all the right tools and assets to handle any type of tax deadline and tax due date. A table showing the semiweekly deposit due.