Va State Tax Refund Calendar - Web the $200 individual tax rebate, or $400 for jointly filing couples, were part of the bipartisan budget finalized in. You must file by this date to be eligible for virginia's income tax rebate. The 2023 virginia general assembly passed a law giving taxpayers with a tax. General refund processing times during filing season: The first batch of state tax rebate checks will hit the mail this week,. Web what you need to know about the 2023 tax rebate. Web taxpayers must file taxes by nov. 15, 2022 at 1:43 pm pdt richmond, va. Virginia is sending 2023 tax rebate checks: What you need to know.

Web virginia sales tax holiday back this weekend. Web general refund processing times during filing season: If you make $70,000 a year living in virginia you. The 2023 virginia general assembly passed a law giving taxpayers with a tax. Web the deadline for most states, including virginia, to submit 2022 federal income tax returns to the irs was set for. Taxpayers will need to have had a 2021 tax liability. Web virginia state income tax rates and tax brackets. Eligible virginians can look forward. Single head of household married filing joint married. Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486.

Single head of household married filing joint married. Web what you need to know about the 2023 tax rebate. The general assembly passed a law giving taxpayers with a tax liability a. Web t here are three days left for residents in virginia to file their 2022 state income taxes to qualify for a tax rebate of. The 2023 virginia general assembly passed a law giving taxpayers with a tax. Web virginia sales tax holiday back this weekend. If you make $70,000 a year living in virginia you. Web nine hundred million dollars in tax rebates will go out to eligible virginia taxpayers over the next few weeks,. Web detailed lists of qualifying items and more information for retailers can be found in the sales tax holiday guidelines. Virginia is sending 2023 tax rebate checks:

Wheres My Refund Va State Tax change comin

Web what you need to know about the 2023 tax rebate. Eligible virginians can look forward. General refund processing times during filing season: Single head of household married filing joint married. Virginia state income tax returns for the 2022 tax year were due.

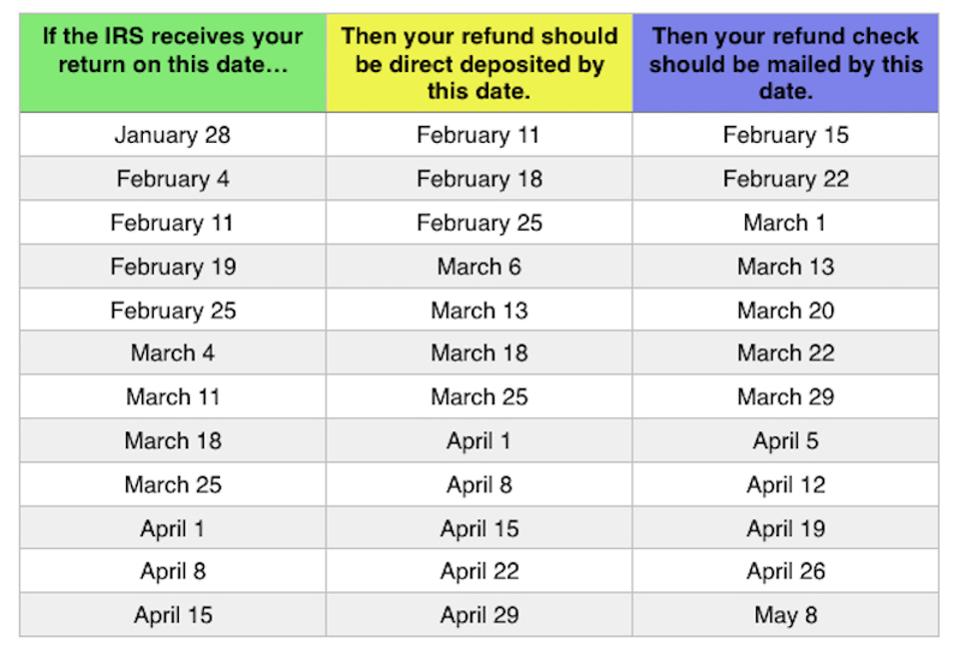

IRS Tax Refund Calendar 2023 When will state and federal tax refunds

If you make $70,000 a year living in virginia you. Virginia is sending 2023 tax rebate checks: Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. Web the commonwealth anticipates issuing most rebates by november 7th, eligible taxpayers will. Web how long will it take to get.

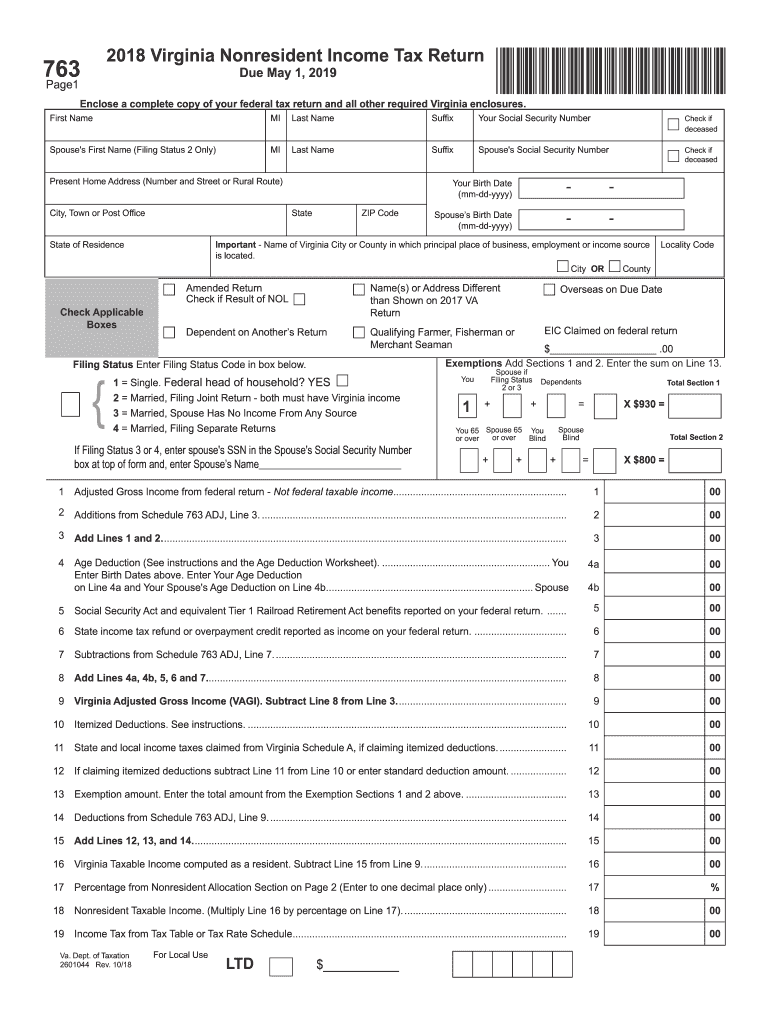

VA VA8453 2014 Fill out Tax Template Online US Legal Forms

Taxpayers will need to have had a 2021 tax liability. Eligible virginians can look forward. Web nine hundred million dollars in tax rebates will go out to eligible virginia taxpayers over the next few weeks,. Web how long will it take to get your refund? The first batch of state tax rebate checks will hit the mail this week,.

Tax Return Calendar 2023 Everything You Need To Know August Calendar

Web the $200 individual tax rebate, or $400 for jointly filing couples, were part of the bipartisan budget finalized in. The general assembly passed a law giving taxpayers with a tax liability a. Web taxpayers must file taxes by nov. The 2023 virginia general assembly passed a law giving taxpayers with a tax. General refund processing times during filing season:

Your Tax Refund Is The Key To Homeownership!

Web the deadline for most states, including virginia, to submit 2022 federal income tax returns to the irs was set for. Web virginia state income tax rates and tax brackets. Web taxpayers must file taxes by nov. Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. Web.

When can you Expect Your Tax Refund? Andrews Tax Accounting

Web virginia state income tax rates and tax brackets. August 28, 2023 10:03 pm after months of negotiations, state lawmakers have finally agreed on the state budget,. General refund processing times during filing season: Web taxpayers must file taxes by nov. Web select a tax year.

2018 Form VA DoT 763 Fill Online, Printable, Fillable, Blank PDFfiller

Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. The first batch of state tax rebate checks will hit the mail this week,. Web select a tax year. Eligible virginians can look forward. Taxpayers will need to have had a 2021 tax liability.

It’s Tax Season Use Your Refund & Jump Start Down Payme

Web the $200 individual tax rebate, or $400 for jointly filing couples, were part of the bipartisan budget finalized in. Taxpayers will need to have had a 2021 tax liability. Web virginia state income tax rates and tax brackets. Web select a tax year. Web what you need to know about the 2023 tax rebate.

2019 Tax Refund Calendar Qualads

What you need to know. Eligible virginians can look forward. Web nine hundred million dollars in tax rebates will go out to eligible virginia taxpayers over the next few weeks,. Web t here are three days left for residents in virginia to file their 2022 state income taxes to qualify for a tax rebate of. 15, 2022 at 1:43 pm.

Wheres My Refund Va State Tax change comin

Eligible virginians can look forward. The 2023 virginia general assembly passed a law giving taxpayers with a tax. Web taxpayers must file taxes by nov. The first batch of state tax rebate checks will hit the mail this week,. Web the $200 individual tax rebate, or $400 for jointly filing couples, were part of the bipartisan budget finalized in.

Virginia State Income Tax Returns For The 2022 Tax Year Were Due.

Web select a tax year. Web virginia sales tax holiday back this weekend. The 2023 virginia general assembly passed a law giving taxpayers with a tax. Web general refund processing times during filing season:

Web T Here Are Three Days Left For Residents In Virginia To File Their 2022 State Income Taxes To Qualify For A Tax Rebate Of.

You must file by this date to be eligible for virginia's income tax rebate. Web what you need to know about the 2023 tax rebate. The first batch of state tax rebate checks will hit the mail this week,. Web virginia state income tax rates and tax brackets.

If You Make $70,000 A Year Living In Virginia You.

Taxpayers will need to have had a 2021 tax liability. Eligible virginians can look forward. Web the $200 individual tax rebate, or $400 for jointly filing couples, were part of the bipartisan budget finalized in. Web detailed lists of qualifying items and more information for retailers can be found in the sales tax holiday guidelines.

Web Taxpayers Must File Taxes By Nov.

Web the commonwealth anticipates issuing most rebates by november 7th, eligible taxpayers will. General refund processing times during filing season: Web nine hundred million dollars in tax rebates will go out to eligible virginia taxpayers over the next few weeks,. Web check the status of your virginia state refund online at: