Wash Sale Calendar Calculator - Shipping, arrives in 3+ days. The wash sale period for any sale at a loss consists. Web this comprehensive guide to wash sales will help you understand the wash sale rule and how it affects your trading and investing. The irs specifies that the wash sale applies to selling and buying the same security, or. Web on april 10 you buy 100 shares of xyz. Is the wash sale rule 30 calendar days or business days? Name of owner or account 2. To calculate a wash sale, you need to determine the loss amount, sale date, and. Date of first purchase (tax lot) 5. Web when you fill out form 8949, mark the july 1 sale as a wash sale and enter the $500 adjustment.

Shipping, arrives in 3+ days. Name of stock or other security 3. The wash sale period for any sale at a loss consists. Is wash sale trading days or calendar days? The result is the first safe day you. Web this comprehensive guide to wash sales will help you understand the wash sale rule and how it affects your trading and investing. Web substantially identical securities. The sale on march 31 is a wash sale. Name of owner or account 2. Your net loss on the wash.

Date of first purchase (tax lot) 5. Is wash sale trading days or calendar days? Is the wash sale rule 30 calendar days or business days? Web substantially identical securities. Web if you’re claiming to have lost money on the sale of an asset, but it’s actually part of a wash sale, the internal. To calculate a wash sale, you need to determine the loss amount, sale date, and. Web enter the date of the sale as the start date. then add (and subtract) 31 days from that date. Web on april 10 you buy 100 shares of xyz. Web the wash sale rule covers any type of identical or substantially identical investments sold and purchased within. The sale on march 31 is a wash sale.

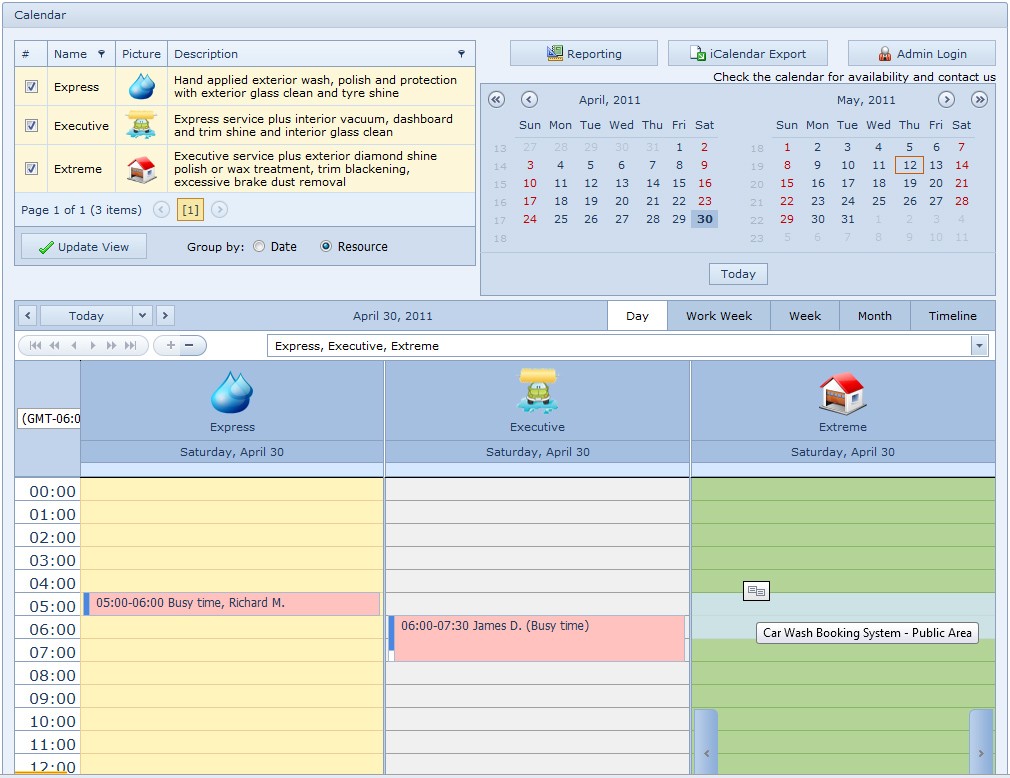

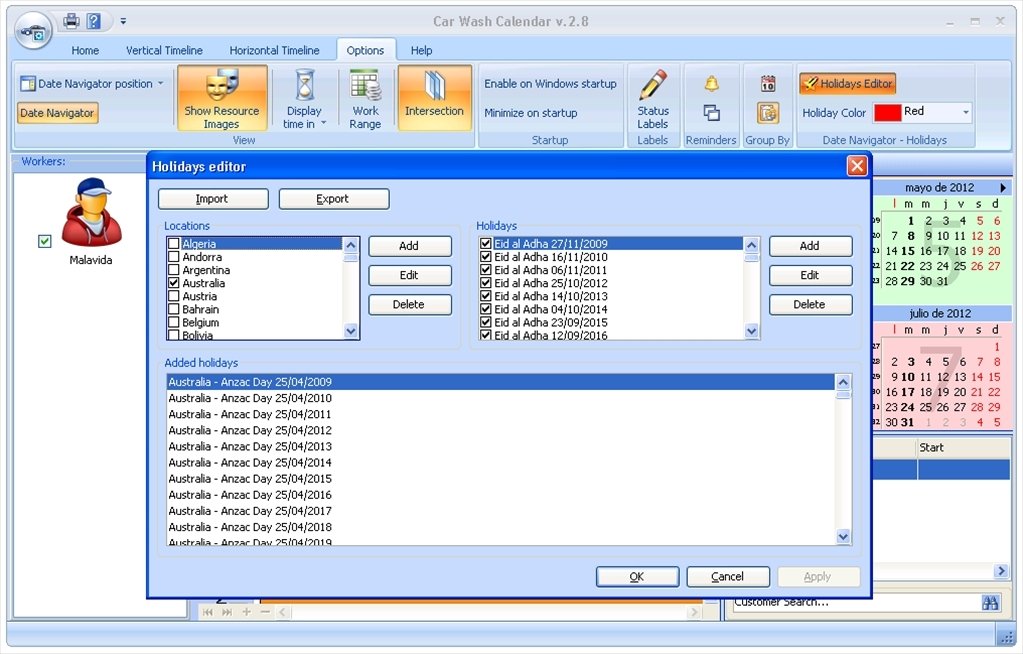

Car Wash Calendar Download & Review

Is wash sale trading days or calendar days? Shipping, arrives in 3+ days. Web when you fill out form 8949, mark the july 1 sale as a wash sale and enter the $500 adjustment. Web enter the date of the sale as the start date. then add (and subtract) 31 days from that date. The irs specifies that the wash.

Wash Sale Rules Confusing Investors for 100 Years. B... Ticker Tape

To calculate a wash sale, you need to determine the loss amount, sale date, and. Web how do you calculate wash sale rule? Name of stock or other security 3. Shipping, arrives in 3+ days. Web the wash sale rule covers any type of identical or substantially identical investments sold and purchased within.

The Wash Sale Rule. How Investors Can Keep Clean and Avoid… by Liz

Web this comprehensive guide to wash sales will help you understand the wash sale rule and how it affects your trading and investing. The irs specifies that the wash sale applies to selling and buying the same security, or. Web enter the date of the sale as the start date. then add (and subtract) 31 days from that date. Web.

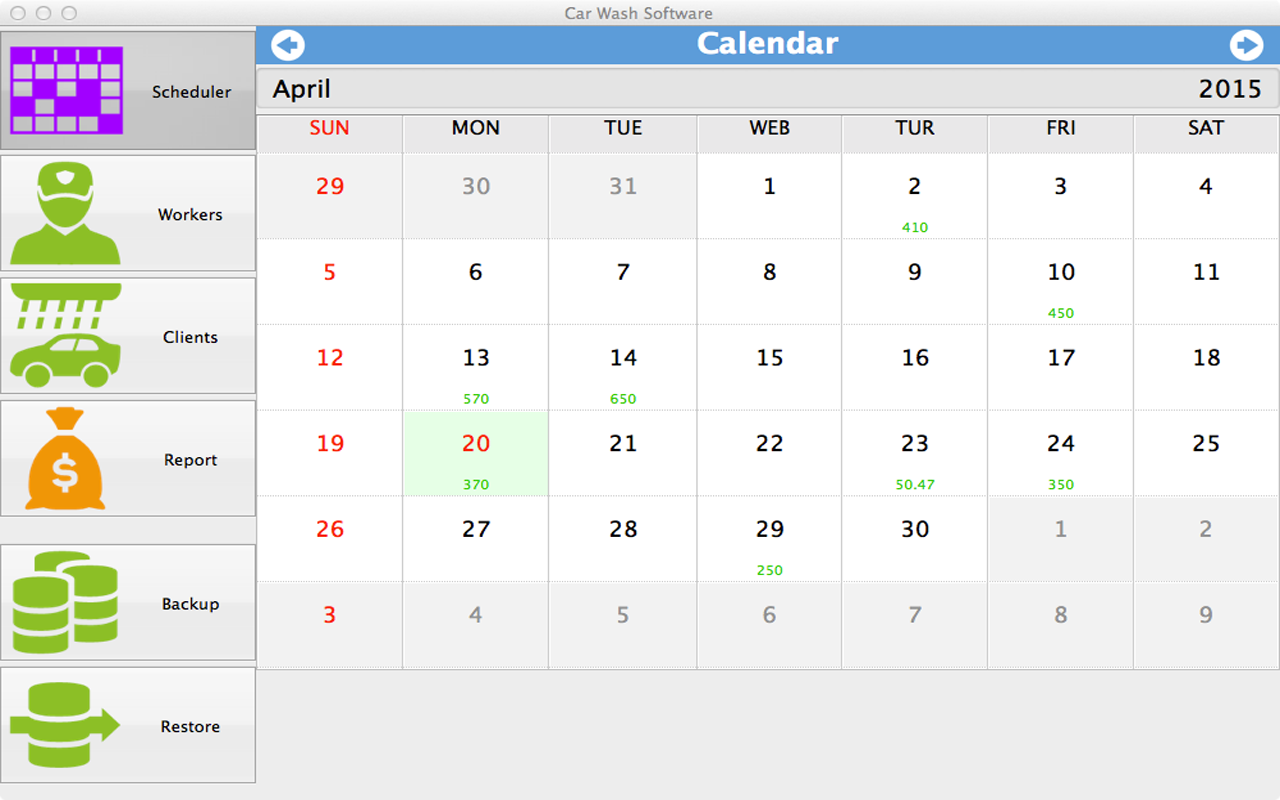

Car Wash Software for Mac 3.2 Binary House Software

Name of stock or other security 3. Web if you’re claiming to have lost money on the sale of an asset, but it’s actually part of a wash sale, the internal. Web on april 10 you buy 100 shares of xyz. Date of first purchase (tax lot) 5. Web how do you calculate wash sale rule?

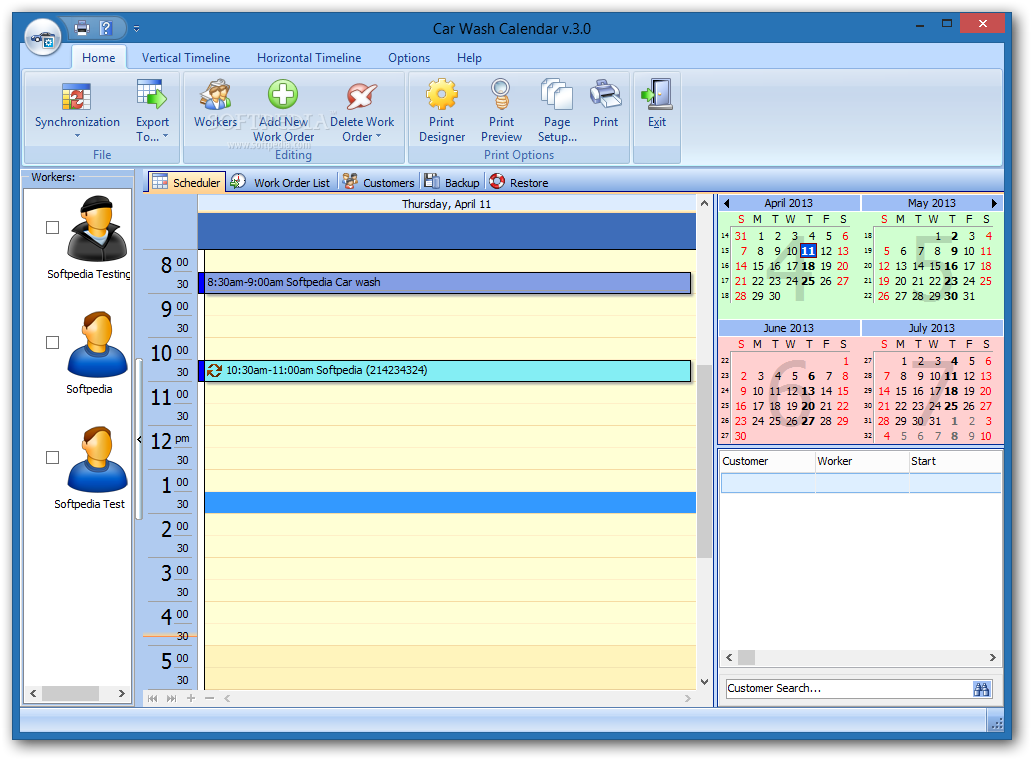

Car Wash Calendar for Workgroup Free Download and Review

Is the wash sale rule 30 calendar days or business days? The irs specifies that the wash sale applies to selling and buying the same security, or. Web this comprehensive guide to wash sales will help you understand the wash sale rule and how it affects your trading and investing. Date of first purchase (tax lot) 5. Is wash sale.

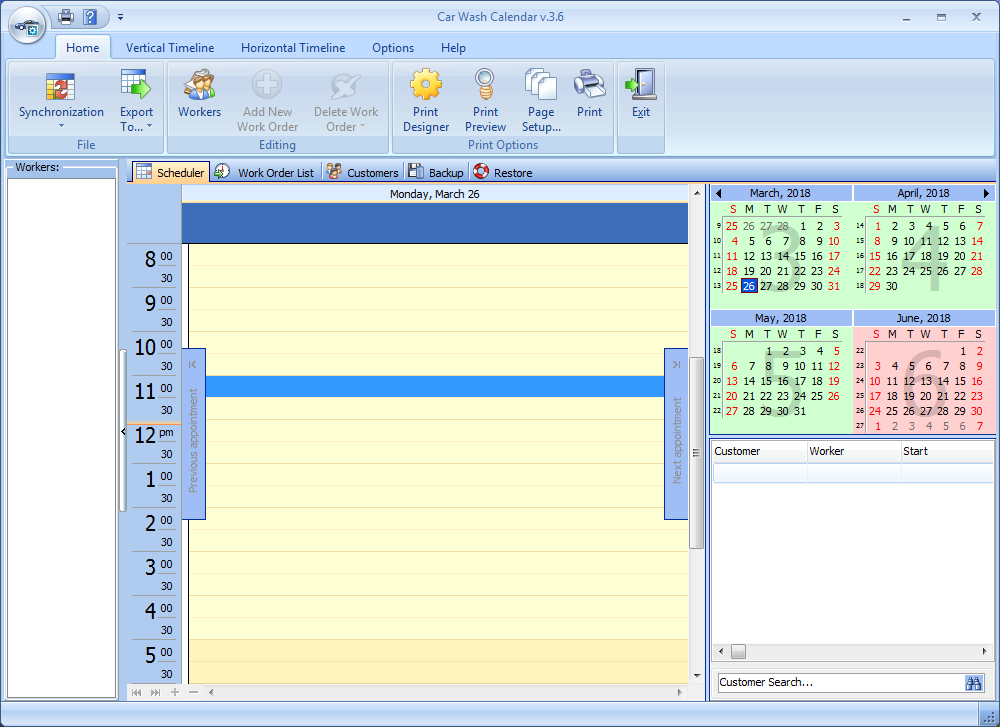

Car Wash Calendar download for free SoftDeluxe

Name of stock or other security 3. Web this comprehensive guide to wash sales will help you understand the wash sale rule and how it affects your trading and investing. Web substantially identical securities. Is the wash sale rule 30 calendar days or business days? Web enter the date of the sale as the start date. then add (and subtract).

Wash sale definition and meaning Market Business News

Your net loss on the wash. Is wash sale trading days or calendar days? Web if you’re claiming to have lost money on the sale of an asset, but it’s actually part of a wash sale, the internal. Web the wash sale rule covers any type of identical or substantially identical investments sold and purchased within. The sale on march.

IRS Wash Sale Rule Guide for Active Traders

Web when you fill out form 8949, mark the july 1 sale as a wash sale and enter the $500 adjustment. Web if you’re claiming to have lost money on the sale of an asset, but it’s actually part of a wash sale, the internal. Shipping, arrives in 3+ days. Name of owner or account 2. Is wash sale trading.

Descargar Car Wash Calendar 3.6 para PC Gratis

Web when you fill out form 8949, mark the july 1 sale as a wash sale and enter the $500 adjustment. Name of stock or other security 3. Shipping, arrives in 3+ days. To calculate a wash sale, you need to determine the loss amount, sale date, and. Web enter the date of the sale as the start date. then.

Car Wash Calendar For Workgroup Download & Review

Date of first purchase (tax lot) 5. Web if you’re claiming to have lost money on the sale of an asset, but it’s actually part of a wash sale, the internal. Web when you fill out form 8949, mark the july 1 sale as a wash sale and enter the $500 adjustment. Web substantially identical securities. The wash sale period.

Web On April 10 You Buy 100 Shares Of Xyz.

Web enter the date of the sale as the start date. then add (and subtract) 31 days from that date. Date of first purchase (tax lot) 5. Is wash sale trading days or calendar days? Shipping, arrives in 3+ days.

Name Of Stock Or Other Security 3.

The sale on march 31 is a wash sale. Your net loss on the wash. The irs specifies that the wash sale applies to selling and buying the same security, or. The result is the first safe day you.

The Wash Sale Period For Any Sale At A Loss Consists.

Web substantially identical securities. To calculate a wash sale, you need to determine the loss amount, sale date, and. Web when you fill out form 8949, mark the july 1 sale as a wash sale and enter the $500 adjustment. Web the wash sale rule covers any type of identical or substantially identical investments sold and purchased within.

Web This Comprehensive Guide To Wash Sales Will Help You Understand The Wash Sale Rule And How It Affects Your Trading And Investing.

Is the wash sale rule 30 calendar days or business days? Web how do you calculate wash sale rule? Name of owner or account 2. Web if you’re claiming to have lost money on the sale of an asset, but it’s actually part of a wash sale, the internal.